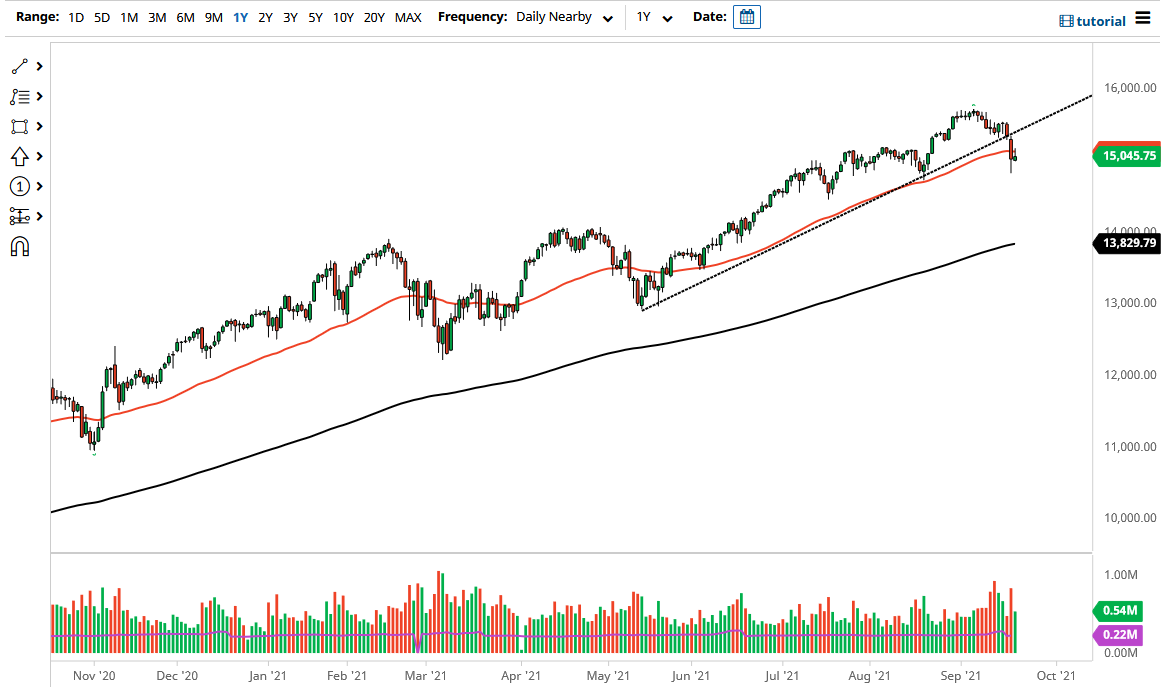

The NASDAQ 100 rallied a bit on Tuesday to reach towards the 50-day EMA again. Ultimately, this is a market that has been finding support near the 15,000 level. I think it will continue to see a lot of noisy behavior, as we had recently broken down, and at this point it looks like we are trying to test whether or not the selloff has any strength. If we break down below the bottom of the candlestick for Monday, I think that opens up a bit of a “trapdoor” for selling pressure.

Keep in mind that the NASDAQ 100 is highly driven by just a handful of stocks such as Tesla, Alphabet, and of course Microsoft. Because of this, you need to take a look at those stocks to get an idea as to where this index goes, as they make up a bulk of the measurement. Quite frankly, it has nothing to do with the other 90 stocks, it is just those 7-10 stocks that matter. If we can break above the candlestick from the trading session on Monday, then it is likely that we could go higher. That being said though, the market has a lot of work to do before that happens, so I would not necessarily count on it.

It would be only a matter of time before the Federal Reserve would do something if the market were to break down significantly, but we are nowhere near there. Breaking down below the 15,000 level would be a sign that we could get in a bit more trouble. The market has needed to pull back for quite some time, so to be honest this might be the healthiest thing this market could have. This is a market that I think continues to find reasons to go higher over the longer term but might have some work to do to get there. I think the one thing you can probably count on is a lot of noisy trading, and if we do break down below the Monday candlestick, I will be a buyer of puts, but I will not short this market as it is reckless to do such things with the central banks interfering continually.