Despite global concerns, which usually serve as a fertile environment for gold, a strong US dollar pushed gold to the $1728 support level, a 7-month low, before settling around $1740 as of this writing. Gold prices fell as a strong dollar and rising Treasury yields weighed on the safe-haven metal.

The yield on the US 10-year Treasury bond rose to more than 1.5%, the highest level in three months, amid growing expectations that the Federal Reserve will reduce its bond-buying program for the foreseeable future. Also, the US Dollar Index (DXY), which measures the performance of the US dollar against a basket of six major competing currencies, rose to 93.81, up nearly 0.5%.

Silver futures settled at $22.467 an ounce, while copper futures settled at $4.2465 a pound.

Recently, US Federal Reserve Chairman Jerome Powell warned members of the Senate Banking Committee of the upside risks of inflation during his testimony yesterday. In prepared remarks, Powell expected inflation to remain elevated in the coming months before it calms down. "As the economy continues to open and spending picks up, we are seeing upward pressures on prices, particularly due to supply bottlenecks in some sectors," Powell stated.

"If persistently high inflation becomes a serious concern, we will certainly respond and use our tools to ensure that inflation is running at levels consistent with our objective," the Fed chief added.

Meanwhile, a report from the Conference Board showed a continued deterioration in US consumer confidence in September. The Consumer Confidence Index declined to a reading of 109.3 in September from an upwardly revised 115.2 in August. The drop surprised economists who had expected the index to rise slightly to 114.8 from 113.8 originally reported for the previous month.

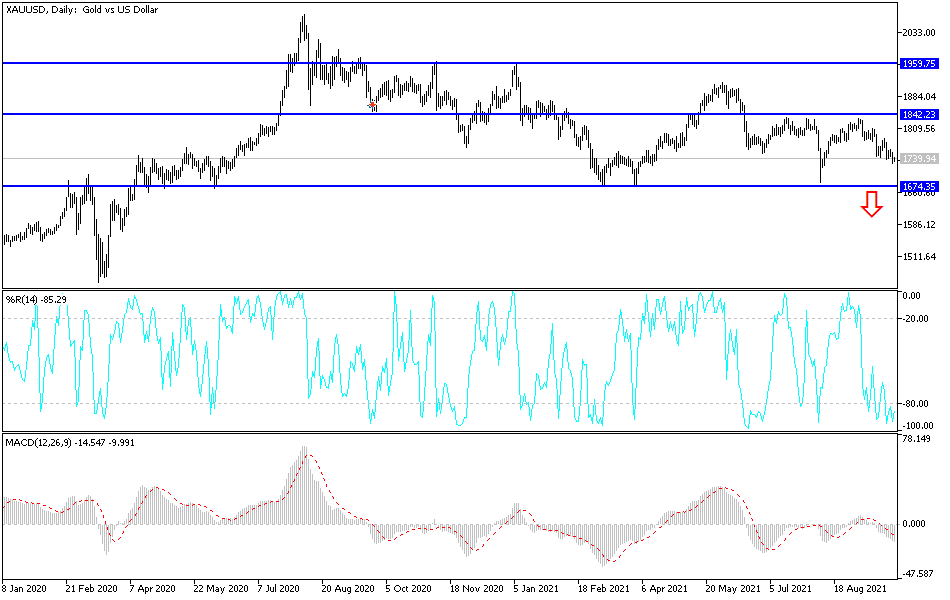

Technical analysis of gold

The sharp losses in the gold price pushed technical indicators towards oversold levels, and despite the selloffs, I still prefer buying gold from every dip. he closest support levels for gold are currently $1725, $1710 and $1675. On the upside, gold will not abandon the current bearish view without moving towards the psychological resistance of $1800. Otherwise, the general trend of gold will remain bearish.