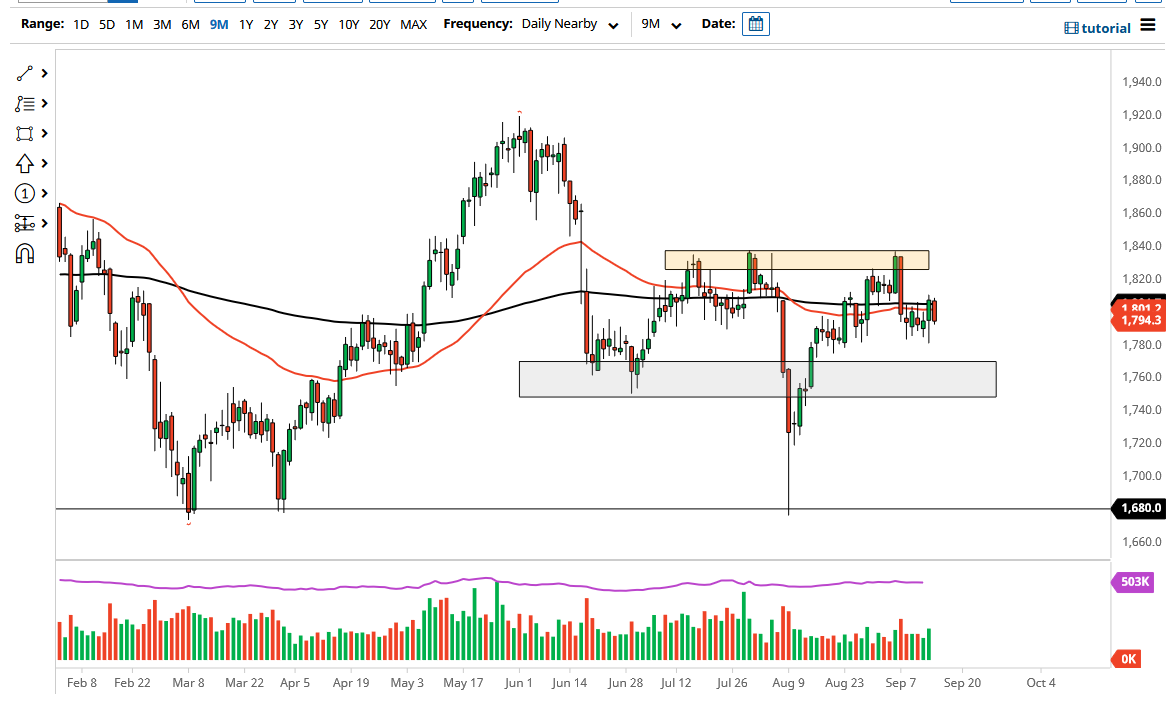

The gold market has pulled back a bit during the course of the trading session on Wednesday as we trying to break above the 200 day EMA. The fact that we have pulled back from there and wiped out most of the body of the candlestick from the Tuesday session suggests that we are going to continue to see a lot of hesitation. The market has bang around in this area for a while, and the fact that we could not continue the upward momentum tells me that the market is still not ready to make up its mind for the bigger move.

The bigger move could be a move towards the $1835 level, but we need to clear the highs of the Tuesday session to make that happen. On the other hand, if we were to break down below the bottom of the tale of the Tuesday candlestick, then it is likely that we go looking towards $1775 level, and then possibly even the $1750 level. Both of those are areas that have been important in the past, but ultimately, I think that if we do break down towards those areas, we probably open up for a bigger move to the downside. That move could be down to the $1680 level, which is where we had bounced from multiple times in the past. I think that there is a larger “buy-and-hold” type of attitude in that vicinity.

Looking at this chart, we can see that we have been going sideways for a while, and therefore I think that we are trying to build up the necessary momentum to make a bigger move. After all, gold does tend to be highly sensitive to multiple things, not the least of which would be interest rates in the United States and the US dollar itself. The US dollar tends to be the exact opposite of gold, so if the greenback starts to pick up again, it will probably drive the value of gold lower. Obviously, the exact opposite is true as well. Because of this, I think the market is probably going to continue to see a lot of questions asked in this general vicinity, and therefore we will eventually get an impulsive candlestick that we can trade off of quite aggressively. Right now, we are still stuck in neutral.