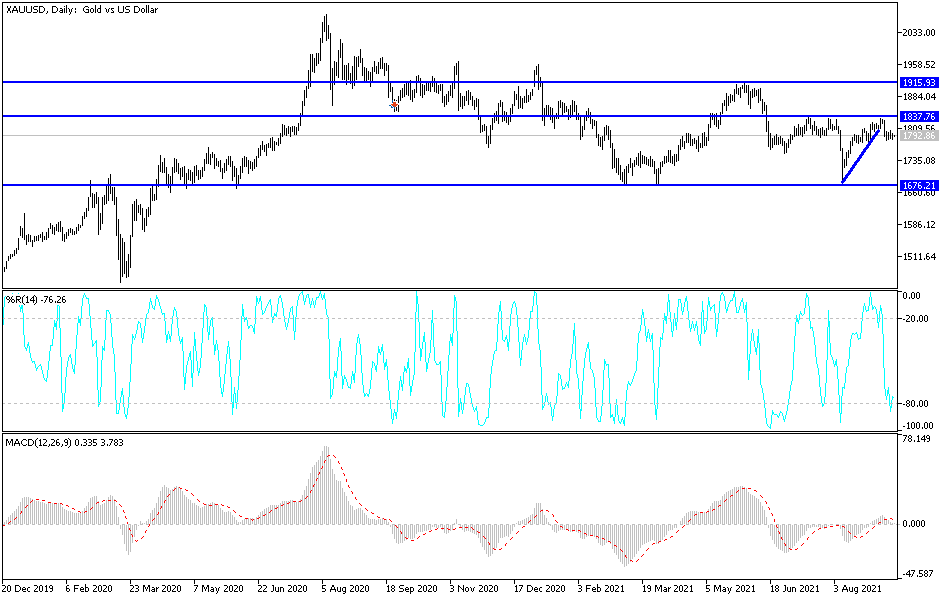

Gold fluctuated on Monday as it stays within the same consolidation area it has been in over the last four days. As long as we stay in this range, I think it is very difficult to get significantly aggressive due to the fact that there seems to be no real rush to get moving in one direction or another. If we break down below the lows of the last four sessions, then it is likely that we will drop towards the $1775 level, maybe even down to the $1750 level. That is a significant support level from the past, but I would be a bit surprised if it held due to the significance of a short-term breakdown.

On the other hand, the market breaking above the 200-day EMA could open up a move towards the $1835 level, an area that has been massive resistance previously. The market breaking above there could open up the possibility of a move towards the $1860 level, and then eventually the $1900 level. The market breaking out above the $1885 level could open up quite a bit of bullish pressure, and then could see a rush of traders jumping into the picture.

I do believe that you have to pay close attention to the US Dollar Index, which is an area of trading that has a major negative influence on this commodity, as the gold markets are priced in US dollars. The question now is whether or not that huge red candlestick from a couple of days back has happened in a vacuum, or if it is a sign of something bigger. It is very unlikely that the market will continue to see at least some selling pressure due to the fact that those candlesticks very rarely happen out of the blue and then get turned around.

Pay close attention to the interest rates in the United States, because if they start to rise again, that typically makes for bad sailing when it comes to the gold markets in general. I think that choppiness will probably be the biggest factor in the markets going forward, and I would be very cautious about my position size until we get a bit more in the way of clarity.