Gold markets were choppy again on Friday as options expiration may have been a bit of a factor. Nonetheless, the market has been stuck in a range sitting just below the 200-day and the 50-day moving averages. Both of those moving averages are relatively flat, so it does make sense that we would go nowhere. Furthermore, the US dollar has been all over the place, and that has its present felt in this market.

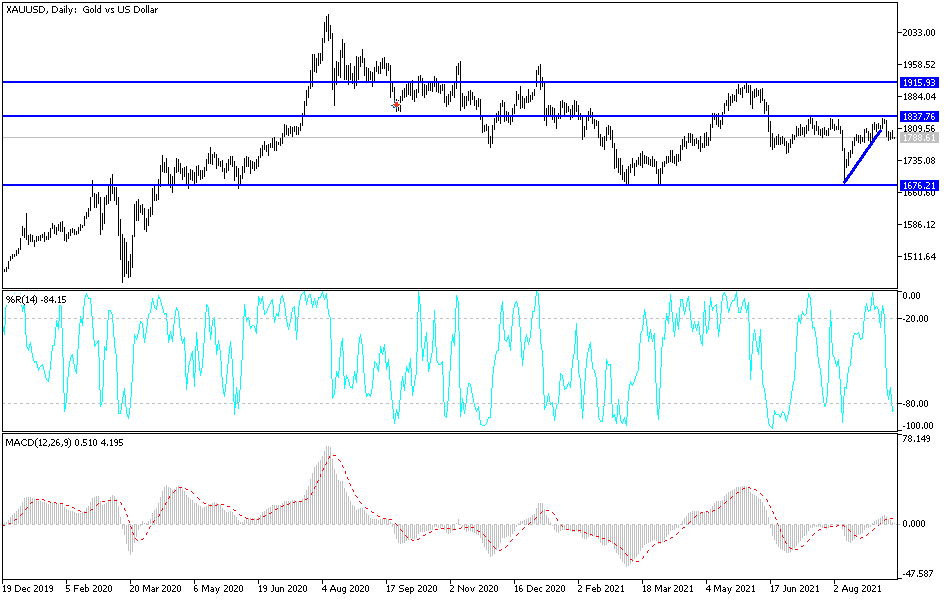

The shape of the candlestick was somewhat like a shooting star, which is a very negative shape. This also sets up the possibility that we will break out to the upside and power through the last three days. If we were to do that, then I believe that this market will go looking towards the $1835 level above, an area that has been so significantly resistant. If that area were to finally get broken, that would be very bullish for gold and send the markets much higher.

To the downside, I see the $1775 level as the initial support for the market. Any breach of that level will more than likely open up a move towards the $1750 level. After that, then we start to look at the $1680 level, an area that has been a massive floor in the market multiple times. Any breach of that would kick off a bear market in gold, probably relating mainly to some type of major rush into the greenback. In that scenario, everything probably will get sold, not just gold. You must always keep in mind the negative correlation between the US dollar and the gold market, so you should have the US dollar Index chart open at the same time period if you do not have the ability to track that live, using the EUR/USD currency pair is a close enough approximation of the US Dollar Index.

That being said, it is worth noting that the Federal Reserve is rather dovish at the moment, even though they are starting to pretend like tapering is going to begin at the end of the year. This is a story that we have seen play out more than once, and because of this I would not hold my breath. Even if they do, it's not necessarily going to signal rising interest rates.