The energy crisis in Britain has increased fears of an economic slowdown, putting pressure on the Bank of England's monetary policy because inflation may reach record levels. This concern was enough to push the GBP/USD currency pair towards the 1.3505 support level as of this writing, the lowest price for the currency pair since the beginning of the year. Just yesterday, the currency pair collapsed amid the worst daily performance in months, from the 1.3717 resistance level to the 1.3520 support. The British pound was sold off against the other major currencies as global investors dumped stocks and higher-yielding assets in the face of mounting concerns that inflation has been trending higher for too long amid a global energy crisis.

But sterling was easily the worst performer among the world's major currencies, suggesting that there are some real UK-specific factors troubling investors. The surge in UK gas prices to record levels combined with the run-up to the fuel front yards by panicked consumers points to a combination of weak growth and high inflation, a potential negative cocktail for the British economy.

“The pound has weakened sharply against the euro and other currencies due to the ongoing energy crisis,” says Charles Purdy, CEO of Smart Currency Exchange.

Danske Bank also says: “The British pound is the biggest loser among the major foreign currencies today. Domestic developments, a negative supply shock, and higher energy prices only exacerbate matters for the risky pound in global markets.”

A headache for global investors - and not just those looking at the UK - has been the rise in global fuel and energy prices, which have raised the specter of an extended period of high inflation levels. This, in turn, has fueled fears that central banks will have to raise interest rates in order to ensure high levels of inflation do not take hold over the medium term, as BoE Governor Andrew Bailey suggested on Monday.

The result is higher UK bond yields as investors demand more compensation in exchange for holding long-term debt and anticipating higher interest rates at the Bank of England. Now normally under benign market conditions, this may be useful for valuing sterling, but in the current situation, sterling was rising with the growth of UK inflation expectations.

What has changed in the meantime is the market mentality: the potential for high inflation, high interest rates and stunted growth is a bad combination, leading to a drop in stocks that has sent the British pound down.

A key component of the recent market shift in market perception is US Federal Reserve Chairman Jerome Powell who will tell US senators that he believes inflation will remain elevated for longer than previously expected. Powell will provide this prediction as justification for indicating last week that the Fed's quantitative easing program cut is likely to start in November (decreasing), and the program is now likely to be completed by mid-2022.

As a result, the yield paid on US government and corporate bonds has risen, raising financing costs, which in turn will further slow global growth and unnerve investors.

The pound is likely to remain weak against such a backdrop.

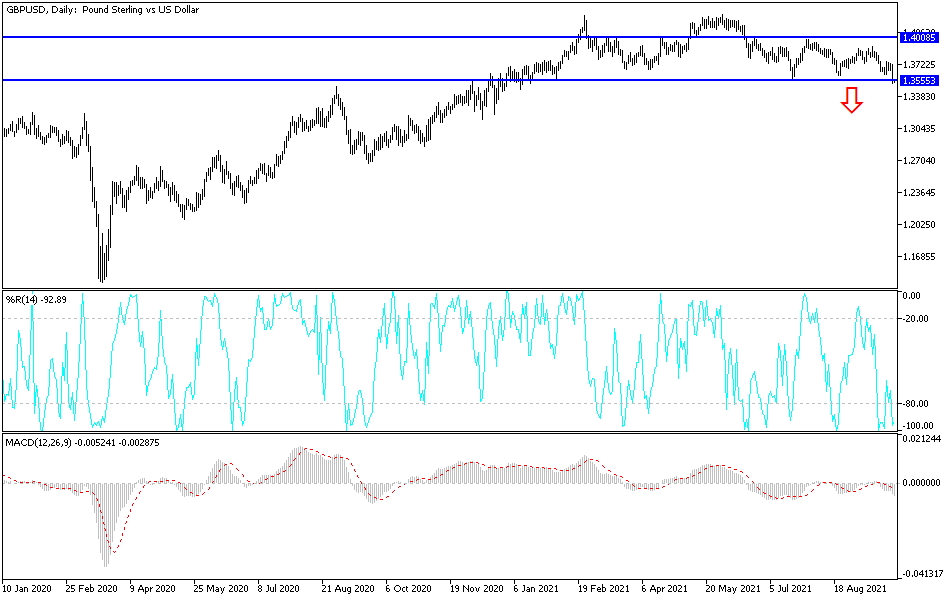

Technical analysis of the pair

The recent losses of the GBP/USD pair were enough to push technical indicators towards oversold levels, but with the continuing concern about the current situation in Britain, the market may ignore this and continue to decline. Therefore, the closest support levels for the current performance may be 1.3445 and 1.3380. It is recommended to buy the pair from the latter level or even below. On the upside, there will not be an initial reversal of the current trend without the currency pair breaching the resistance level at 1.3830. Otherwise, the bears will remain in control, and the currency pair may remain in its current position until a breakthrough in the energy crisis in the country.

The currency pair will be affected today by the comments of monetary policy officials, the statements of the governor of the Bank of England and the chairman of the Fed, in addition to developments in the energy crisis in Britain.