The GBP/USD corrected upwards to the 1.3865 resistance level, a rebound from sharp losses incurred last week, which reached the support level of 1.3726. The gains of the pound came against the rest of the other major currencies, as timely economic activity data from the Office for National Statistics indicate that Britain's economic recovery gained momentum in early September, suggesting that the recovery may pick up again at the end of the year.

A series of near-term pilot data from the Office for National Statistics reveals that credit card spending increased by 6 percentage points in the week ending September 2, reaching 99% from its average in February 2020. The data will be collected by economists to assess whether the slowdown in The recovery during the summer months has given way to higher growth rates, something other surveys indicate.

Andrew Goodwin, chief UK economist at Oxford Economics, says: “The bulk of the gains from reopening the UK economy are now behind us, so we are entering a more difficult phase of recovery. But the promise of a strong rebound in consumer spending and business investment means that our outlook remains bullish."

CHAPS data from the Bank of England is being tested by the Office for National Statistics as a faster indicator of UK spending on credit and debit cards. It gives insight into consumer behavior and is used by economists to assess how the recovery is progressing in the UK. But next week's data series will be of great interest as it will capture the "back to school" impact of the week beginning September 5.

It was reported that Monday saw significant increases in traffic as workers returned to their desks and suggests that the "back to school" effect after the summer could herald a more decisive return to normalcy for the British economy. Transport for London reported that morning trips on the Underground were up 17% from the previous week, and buses saw 39% more passengers. The Office for National Statistics reported that the volume of motor vehicle traffic on Monday, September 6, reached 100% of its level in the first week of February 2020.

Eurocontrol data showed that the average number of daily flights in the UK for seven days was 3,589 in the week ending September 5, an increase of 5% from the previous week and the highest average number of UK flights for nearly 18 months.

The trajectory of UK economic growth slowed in the summer months as consumers sounded more cautious in light of the rise in COVID cases. Cases remain high but acceptance that the disease has become endemic and that vaccines protect against severe disease may be reflected in consumer behaviour. The end of self-isolation rules on August 16 meant people could go about their daily lives without fear of being pressured by the NHS enforcement with instructions to isolate.

This coincides with seasonal trends of schools reopening and parents returning to work.

But scientists warn that cases of COVID could increase again in the fall as is the case with these types of respiratory viruses. The UK has a high prevalence of COVID and any increase in cases could put pressure on the NHS. Therefore, the recovery may be turned upside down due to the re-emergence of the virus.

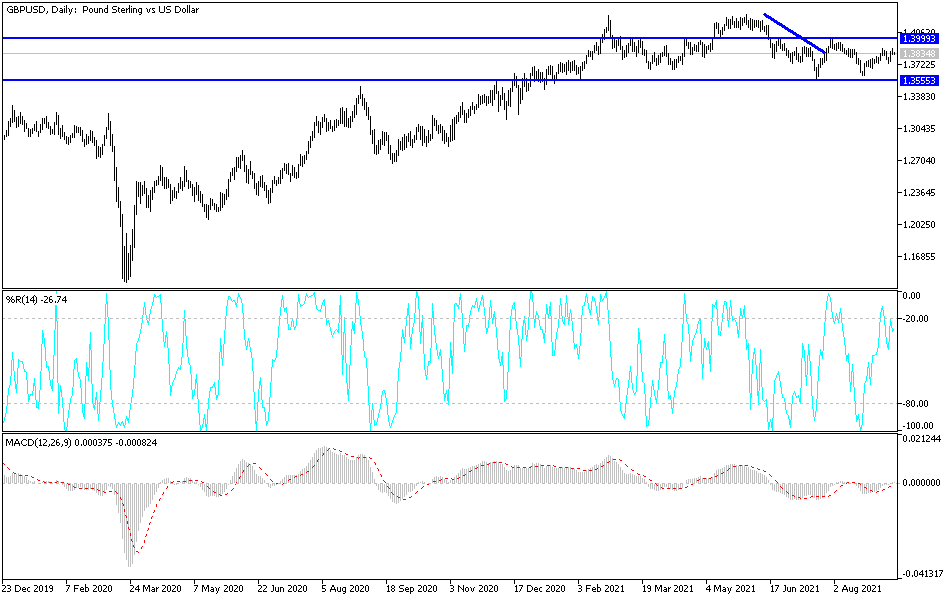

Technical analysis of the pair

Breaking through the 1.3900 resistance will push the currency pair to a bullish weekly close. On the daily chart, stability above this resistance will motivate the bulls to move towards the psychological resistance 1.4000, but the pair is still vulnerable to fluctuations from the recent skirmishes between the two sides of Brexit, the increasing cases of epidemic infections, and the slowdown in the British economic performance. This may be evident in the GDP data and industrial production today.

On the other hand, the opportunity for the bears to control the performance is still valid, especially if the currency pair returns to the support level at 1.3775 again.