The energy crisis, Brexit skirmishes, weak British economic performance and corona variants all pushed the GBP/USD down to the 1.3640 support level, where it has settled as of this writing. In addition to these factors, the GBP/USD will interact with the US Federal Reserve’s announcement of its monetary policy decisions with an update of economic expectations, and the greatest focus will be on the tone of the monetary policy statement and the statements of Chairman Jerome Powell to anticipate the future of tightening US monetary policy.

The passing of the Federal Reserve storm will be followed by the policy storm of the Bank of England on Thursday. No policy changes are expected, but if more than one MPC member votes to end quantitative easing immediately, the pound could benefit. In addition, the market could also interpret a number of votes in favor of a rate hike in a pro-GBP manner.

The Bank of England's monetary policy meeting in September comes amid rising gas prices that threaten not only to push inflation higher than the Bank's current forecasts in August but also to slow economic growth. On the one hand, the bank may want to ensure that inflation expectations are not overlooked given the already high levels of inflation, but on the other hand, any "tough" signal on the matter could create headwinds for growth.

Commenting on this, Daraj Maher, Head of Research at HSBC said: “We are maintaining our caution on the pound due to headwinds to growth from supply constraints, withdrawal of government support schemes and higher taxes. The market is already priced to raise rates twice in 2022, so the risk is that the data end up making the tightening very scary."

Barclays economist Sanjay Raja says the current rise in gas prices could lead to a 20% rise in the retail price of gas at Ofgem, which in turn could raise headline inflation by 60 basis points by April. This would be a good boost to the bank's current inflation expectations and raises questions about the sustainability of any argument that high inflation will prove temporary.

The assessment of the foreign exchange market for the gas crisis is that it is negative for economic growth, which was highlighted by the unquestionably weak performance of the pound in recent days. So the drop in the GBP/USD and other GBP exchange rates is a symptom of the market preparing for a cautious tone from the bank.

the upside risk is that BoE Governor Andrew Bailey and other MPC members betray a growing concern about inflation and suggest that a rate hike in 2022 is warranted. Thus, any positive surprises may help the pound recover from its recent lows against the dollar.

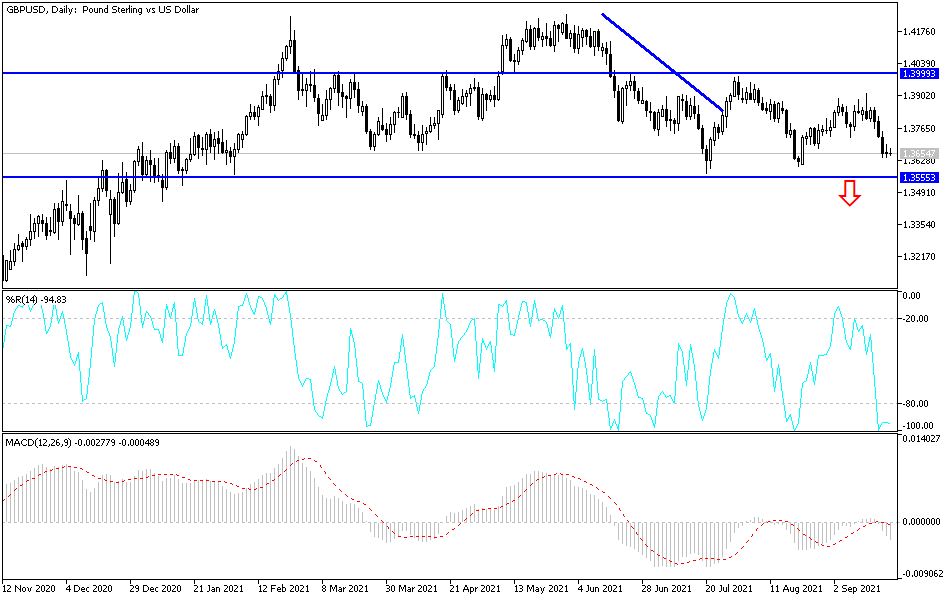

Technical analysis of the pair

On the daily chart, the technical indicators point to the downside, which means a continuation of the current momentum, which in turn means that the pair is set to test the next support levels at 1.3600, 1.3555 and 1.3480. So far, I don't see a convincing reason for the currency pair to return to the 1.4000 psychological resistance any time soon, which would be crucial for the bulls to turn the current outlook to the upside. In light of the current situation, the gains of the GBP/USD will remain a target for selling until the above-mentioned weakness factors are removed.