The GBP/USD continues to collapse, with its losses reaching 1.3411 support level, the lowest since the end of 2020. The currency pair settled around the 1.3425 level at the beginning of Thursday's trading. The pound's losses are increasing in the Forex market amid fears that the UK will suffer greatly from the global energy crisis.

UK inflation is expected to pick up and the BoE appears ready to raise interest rates in response, but growth is expected to take a hit leading to a view among investors that stagflation may be on the horizon. Inflation risks becoming structural as consumers and businesses react to persistently high inflation caused by the type of supply shocks we are currently experiencing. As such, BoE Governor Andrew Bailey expressed his concerns about this development in a speech this week as he said that inflation could become self-sustaining and therefore require central bank intervention.

On the economic side. Yesterday, data from the Bank of England showed UK mortgage approvals fell to a 13-month low in August. According to the results, mortgage approvals for home purchases decreased to 74,453 in August from 75,126 in July. This was the lowest since July 2020. However, approvals remained above pre-February 2020 levels. The expected level was 73,000.

According to the Bank of England, individuals borrowed £5.3 billion of mortgage debt in August, after repaying a net £1.8 billion. Meanwhile, total lending rebounded to 21.5 billion pounds in August from 16.6 billion pounds in July.

Commenting on the figures, Paul Dills, an economist at Capital Economics, said that with the current fuel crisis activity constrained (outside of fuel spending), there is a risk that the economic recovery may take a small step back at some point.

"This will be a piece of mind for the Bank of England, which appears intent on raising interest rates in the coming months," the economist added.

According to the results, individuals borrowed 0.4 billion pounds in the form of consumer credit in August. Within this, they borrowed an additional £0.2 billion in "other" forms of consumer credit and £0.2 billion in credit card debt.

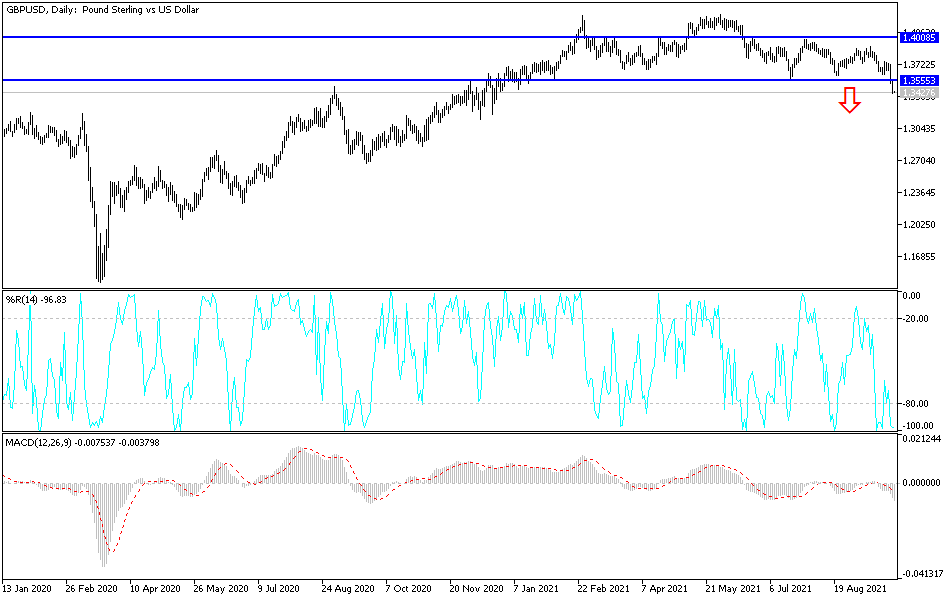

Technical analysis of the pair

The technical indicators reaching strong oversold levels after the recent losses of the GBP/USD pair, which lasted for 12 days, particularly after the energy crisis in Britain became known. Currently, the bears' targets are the support levels at 1.3390 and 1.3280, which are optimal for buying. The pair may move to those levels soon if the negative sentiment of investors continues towards the pound in light of the continuing fuel crisis.

The currency pair may return to breach the last breakdown line shown on the chart by moving towards the resistance levels of 1.3555 and 1.3630. The general trend of the currency pair remains bearish and investor sentiment and the performance of the stock markets will remain important in determining the direction of the currency pair.

From Britain, the GDP growth rate, current account numbers and the rate of investment in business will be announced. From the United States of America, the GDP growth rate, the number of jobless claims, and new statements from US monetary policy officials will be announced.