At the beginning of this week's trading, the US dollar gained some momentum against the other major currencies. But in the case of the GBP/USD pair, it showed resilience after the pair fell to the support level 1.3796, stabilizing around the 1.3840 level as of this writing ahead of the job and wage numbers from Britain. The currency pair is trying to recover further.

The US dollar rose against the other major currencies amid what was often turbulent trading for the stock and commodity markets, but the British pound did better against the US dollar than many other currencies last week overall. The British pound was not without a rally last Thursday which probably had the same amount of domestic momentum with the international tailwinds behind it after the August monetary policy report hearing in Parliament.

Parliamentary testimony from Bank of England Governor Andrew Bailey and colleagues has boosted market expectations of a rate hike next year, combined with the dollar's decline in the past two weeks, helping to cleverly lift sterling from its lows in late August. The latter was not quite as low as the one seen in July, and so it at least seems to indicate that the June corrective setback to the GBP bullish trend may be on course, although nothing can be ruled out for the coming weeks and months.

Other economic releases this week (industrial production, retail sales, University of Michigan sentiment) may also have a limited impact. We tend to think that markets may take a wait-and-see approach ahead of the very busy week of September 20-24 regarding Fed activity.

In turn, the British calendar may take the sterling in any direction this week, but it remains to be seen whether the dollar will find inspiration from US economic indicators that include inflation and retail sales numbers for August because the Fed has pegged the timing of any decision to end the £120 billion per month quantitative easing program to bring about a significant recovery to jobs lost in attempts to contain the coronavirus.

The US non-farm payrolls report for August indicated that October may be too early for the Fed to be satisfied with its terms, while the US central bank's focus on the labor market means this week's US data may have limited effects on the dollar. This in turn suggests that investors' fluctuating appetite for riskier currencies may eventually be the most pervasive impact on the dollar instead, although the sterling price will be affected along the way by Tuesday's UK jobs data and August inflation figures on Wednesday.

Commenting on this, Jessica Hinds, an economist at Capital Economics, says, “Inflation could grab the headlines next week, if we are correct in believing that the data will show that CPI inflation jumped from 2.0% in July to 3.1% in August. In the meantime, we also expect to know this week that the unemployment rate fell from 4.7% in June to 4.5% in July and that retail sales reversed a large portion of the 2.5% month-over-month decline in July in August."

The pound may be more sensitive to any second consecutive loss against the inflation consensus, which favors an increase from 2% to 2.9% last month after falling more than expected in July, a month in which the British economy in general has almost stalled. The pound will be interested as the risk of further sharp increases is a large part of the reason why the BoE has indicated that it may start reversing crisis-inspired rate cuts next year.

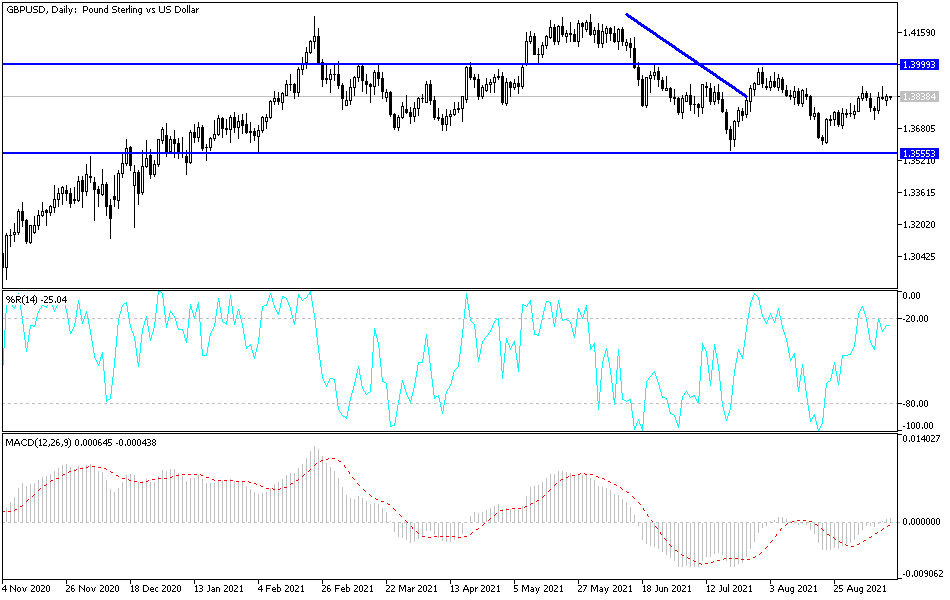

Technical analysis of the pair

The steadfastness of the GBP/USD in the face of the dollar's continued gains depends on the bulls' success in pushing the currency pair past the 1.4000 psychological resistance, which stimulates more buying and confirms the bullish performance. On the daily chart, the bears' control will increase in case the currency pair moves towards the support levels 1.3735 & 1.3680. There is a neutral trend with an upward bias that needs more catalysts.

The pound will be affected by the announcement of the rate of change in jobs, the unemployment rate and average wages. The US dollar will be affected by the announcement of inflation figures through the Consumer Price Index.