Bullish View

Set a buy-stop at 1.3460 and a take-profit at 1.3600.

Add a stop-loss at 1.3400.

Timeline: 2 days.

Bearish View

Set a sell-stop at 1.3400 and a take-profit at 1.3300.

Add a stop-loss at 1.3500.

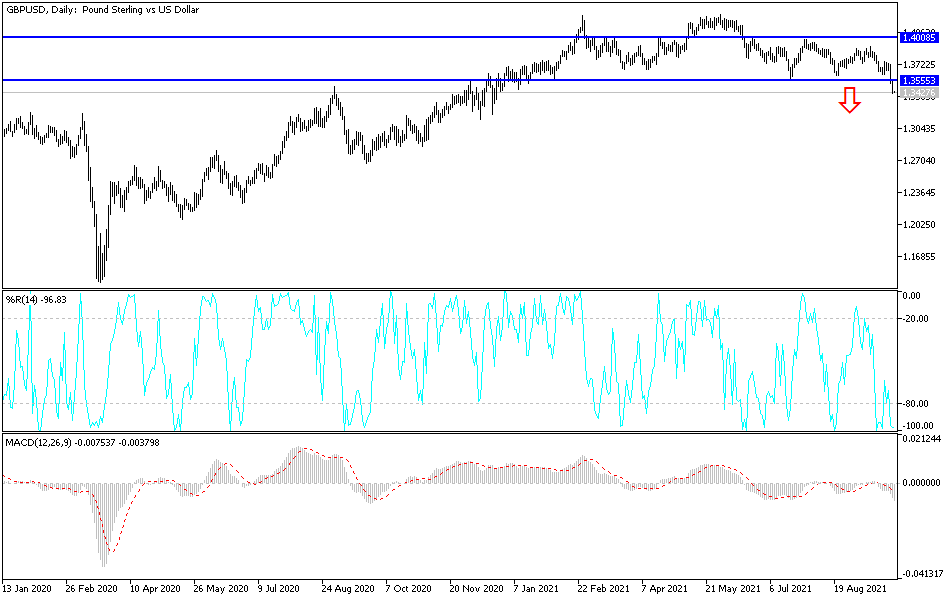

The GBP/USD pair crashed to the lowest level since December as risks of a UK economic stagflation rose. The pair dropped to 1.3412, which was 3.62% below the highest level this month.

Stagflation Fears Rise

Stagflation is an economic situation in which a country records slow economic growth and a higher inflation rate. It is often considered to be one of the worst economic situations that a country can be in.

There is an ongoing fear that the UK economy will go through stagflation in the near term. Recent data showed that consumer prices jumped to 3.2% in August. In its interest rate decision, the Bank of England (BOE) warned that prices will jump by about 4% later this year.

Analysts now believe that inflation will rise by more than 4% as energy prices rise. Many petrol stations have run out of fuel while the price of gas has jumped to a record high. At the same time, many retailers have been forced to increase prices because of product and drivers shortages.

The GBP/USD pair has also declined because of the overall stronger US dollar. The US Dollar Index has jumped to the highest level since June as risks from the US rise. Congress is divided about how to fund the government, meaning that there is a possibility that a partial government shutdown will start this week.

The most severe situation will happen if Congress fails to pass a bill to expand or suspend the debt ceiling. This will push the country to default on its obligations, which will lead to higher cost of borrowing. It will be the first time on record for the US government to default.

Later today, the pair will react to the final estimate of US GDP numbers and last week’s initial jobless claims numbers.

GBP/USD Forecast

The four-hour chart shows that the GBP/USD has been in a strong bearish trend lately. It dropped to 1.3412, which is significantly below where it started the week. Along the way, it dropped below the key support level at 1.3600, where it struggled moving below several times before.

The pair also dropped below the 25-day and 50-day moving averages while the Relative Strength Index (RSI) declined to the oversold level. Therefore, while the pair may keep falling, there is a likelihood that a relief rally will happen as investors rush to buy the dips.