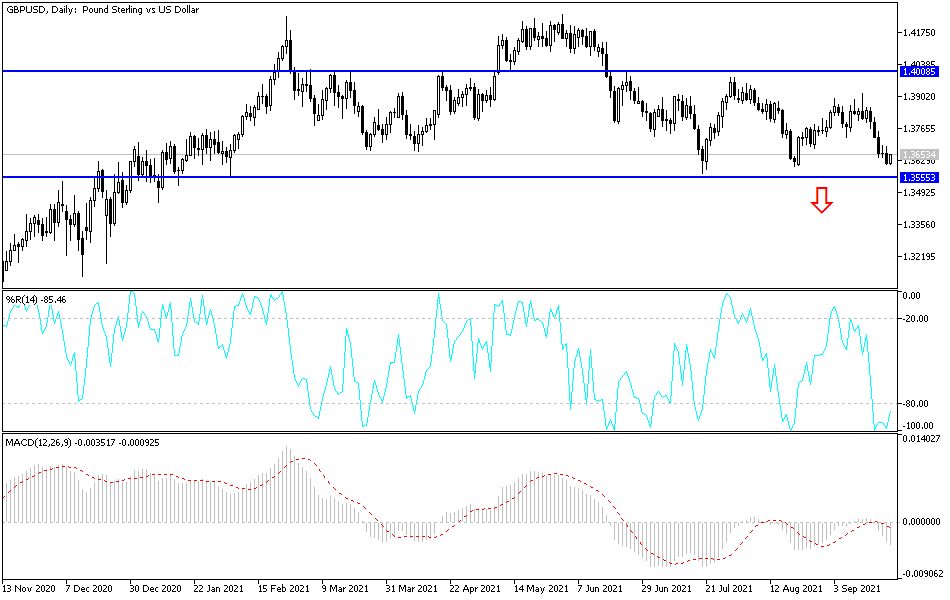

Bearish View

Set a sell-stop at 1.3610 and a take-profit at 1.3500.

Add a stop-loss at 1.3700.

Timeline: 1 day.

Bullish View

Set a buy-stop at 1.3650 and a take-profit at 1.3750.

Add a stop-loss at 3600.

The GBP/USD pair wavered in the overnight session after the relatively hawkish Federal Reserve decision. The pair is trading at 1.3630, which is slightly above the overnight low of 1.3600.

Bank of England Decision

The Federal Reserve made its interest rate decision in the overnight session. As widely expected, the bank decided to leave its interest rate unchanged. However, the dot plot showed that more Fed officials were starting to expect an interest rate hike in the coming year.

The bank also signalled that it will start winding down its massive $120 billion a month quantitative easing program in the coming months. This represented the most hawkish view by the Fed in the past few months.

Focus now shifts to the upcoming Bank of England (BoE) interest rate decision. The bank will conclude its meeting today and make an announcement on QE and rates. Like the Fed, analysts expect that the BoE will sound a bit hawkish in this meeting.

They believe that there will be a unanimous vote on leaving interest rates unchanged. However, there will likely be division among BoE officials who want to end the QE and those who want to continue with the program for a while.

The BoE decision comes at a time when the UK economy has staged a strong recovery. Inflation has risen to 3.2% while the unemployment rate has declined. Still, there are supply-side issues and the ongoing jump in gas prices pose a major risk to the recovery.

The GBP/USD pair will also react to the latest flash Manufacturing and Services PMIs. These numbers will likely show whether the two sectors in the UK maintained their momentum or not. In general, economists expect these numbers to show that the sectors did well in August even as businesses faced supply and worker shortages.

GBP/USD Forecast

The GBP/USD rose to a high of 1.3690 after the Fed decision and then declined to a low of 1.3610 during Jerome Powell’s testimony. On the four-hour chart, the pair remained slightly below the 25-day and 50-day moving averages.

It is also slightly above the key support level at 1.3610, which was the lowest level on August 20. It has formed a small bearish consolidation pattern. Therefore, the pair will likely break out lower before or after the BoE decision.