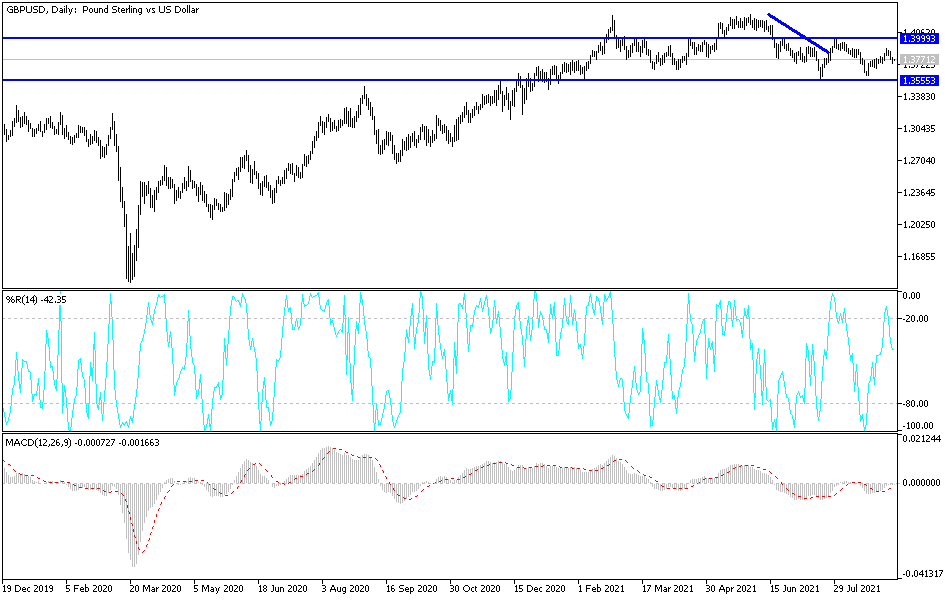

Bearish View

Sell the GBP/USD and add a take-profit at 1.3670.

Add a stop-loss at 1.3850.

Timeline: 1-2 days.

Bullish View

Set a buy-stop at 1.3840 (pivot point).

Add a take-profit at 1.3950 and a stop-loss at 1.3750.

The GBP/USD price rebounded in the overnight session as the market reflected on a testimony by Andrew Bailey, the Bank of England (BOE) governor and the Federal Reserve Beige Book. The pair rose to 1.3780, which was higher than this week's low of 1.3727.

Bailey Testimony

The main catalyst for the GBP/USD was a relatively hawkish statement by Andrew Bailey. Testifying in parliament, the governor reiterated that there was a likelihood that the central bank will hike interest rates in the next few years.

He also flagged the rising risks of inflation as commodity prices remain elevated. Recent data showed that the country’s inflation slowed slightly in July but there is a likelihood that prices will remain higher.

For example, data published last week by Nationwide and this week by Halifax revealed that the country’s home prices rose to a record high in August. At the same time, retailers like Marks and Spencer and Tesco have warned about supply shortages as some Brexit issues remain unresolved.

In the statement, he also flagged the rising labour shortages as a key risk to the UK economic recovery. Indeed, many companies are facing labour shortages, with skills like masonry and meat processors being in high demand.

At the same time, there is the ongoing debate about Boris Johnson's large tax hike. This week, the prime minister unveiled a large hike in a bid to fund the NHS and the retirement budget. Analysts expect the hike to have an impact on the country's recovery in the coming year.

The GBP/USD also reacted to the latest Fed Beige Book. While the report was generally optimistic officials warned that the new wave will likely have an impact on the recovery. Looking ahead, the pair will react to the US initial jobless claims data and the upcoming UK GDP data scheduled for Friday.

GBP/USD Forecast

The three-hour chart shows that the GBP/USD made some recovery on Wednesday during Andrew Bailey's testimony. The pair also rose slightly above the first support of the standard pivot point. It also remains slightly below the 25-day moving average.

At the same time, it has formed a head and shoulders pattern whose head is at the highest level last week. Therefore, there is a likelihood that the pair will maintain the bearish trend as bears target the second support at 1.3670.