Bearish View

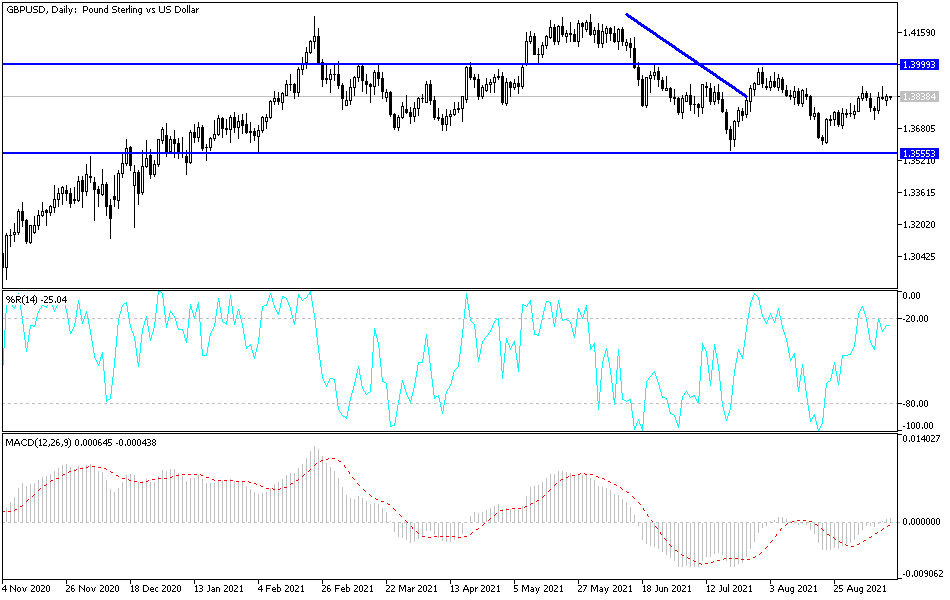

Sell the GBP/USD and set a take-profit at 1.3730.

Add a stop-loss at 1.3890 (double-top area).

Timeline: 1-2 days.

Bullish View

Set a buy-stop at 1.3860 and a take-profit at 1.3950.

Add a stop-loss at 1.3800.

The GBP/USD price was little changed in early trading ahead of the important UK jobs and US Consumer Price Index (CPI) data. The pair is trading at 1.3833, which is slightly below last week’s double-top of 1.3887.

UK Jobs Numbers and US Inflation

The biggest catalyst for the GBP/USD price will be the American consumer inflation data. These numbers will come at a time when the global supply logjam is continuing and wages are rising.

Recently, many companies, including ride-hailing players like Uber and Lyft have been forced to boost their prices. Similarly, the prices of key commodities have risen, with aluminium being at the highest level in 13 years.

Therefore, analysts polled by Reuters expect the data to show that consumer prices rose by 5.3% in August, a small decline from the previous month’s high of 5.4%. Similarly, they expect that the core CPI declined from 4.3% to 4.2%.

Still, these numbers are significantly above the Federal Reserve’s target of 2.0%. As such, the strength of the country’s inflation will likely have an impact on the bank’s upcoming decision. On Friday, data showed that the country’s Producer Price Index (PPI) rose to the highest level in more than 11 years.

The GBP/USD pair will also react to the UK employment numbers for July. Economists expect the data to show that the country added more jobs in July as the country reopened. They see the unemployment rate falling to 4.6%. Still, while the UK labour market remains steady, more than 1.3 million are in the government’s furlough program.

The impact of the UK jobs numbers on the GBP/USD will be muted since investors will be watching for the UK inflation data scheduled for Wednesday.

GBP/USD Price Forecast

The four-hour chart shows that the GBP/USD pair formed a double-top pattern at 1.1833 last week. The lower part of this double-top was at 1.3728. The price is currently slightly above the 25-day and 50-day moving averages. It is also along the 38.2% Fibonacci retracement level while the MACD is slightly above the neutral level.

Therefore, because of the double-top pattern and this month’s Fed decision, the pair will likely maintain the bearish trend, with the next key level to watch being at 1.3730.