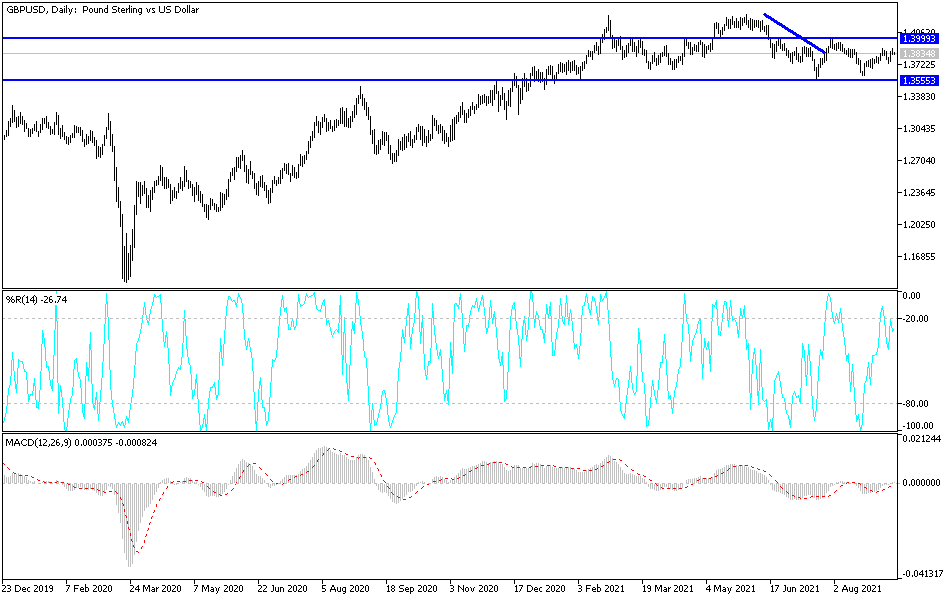

The British pound initially tried to go higher on Friday, breaking above a significant downtrend. However, we have given back those gains to form a negative candlestick as we sit just above the 1.38 handle. That in and of itself is a very negative sign, because it shows the downtrend line that has been so important for so long. Furthermore, you could make an argument for a micro double top, showing that we aren't quite ready to go much higher.

If we do break above the 1.39 level, that would be much more impressive now that we have formed a couple of shooting stars in that area. This would open up a move towards the 1.40 level, an area that has been quite important more than once. After that, we would go looking towards the 1.42 handle. I think a move to the upside is going to be difficult unless we see an overall selling of the U.S. dollar. This will probably have more to do with the greenback than anything else. In any scenario, it would be a major “risk on” turn of events, and you would probably see the US dollar sold against most other currencies. However, at the end of the day on Friday, that is not how things looked across the board.

To the downside, I see the 200-day moving average sitting just above the 1.3700. That's an area that has been significant support over the last couple of weeks, so if we break down below there then we will go testing the double bottom, which is that the 1.36 handle. Breaking that to the downside would more than likely open up fresh selling, perhaps kicking off a major trend.

It is because of the above mentioned observations that I think the next couple of sessions are going to be very crucial for the future of the British pound. A lot of this could come down to global economic fears and concerns, which could have people running towards the safety of the EU treasury market, and then by proxy the US dollar. We will have to see what happens over the next couple of days, but it's clear to me that we are about to make a big move one way or the other. Be cautious about your position size and only add once the trade starts to work in your favor.