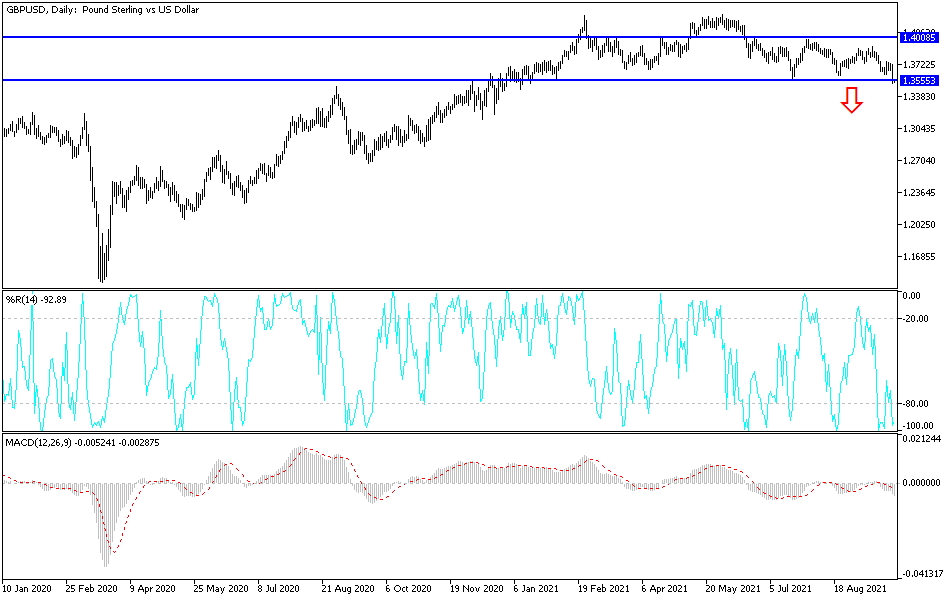

The British pound broke down significantly on Tuesday to slice through the 1.36 handle. By breaking down the way we have, I do suspect that we will go much lower, as we look to the 1.35 handle for support. Breaking below that level could then cause a bit of a collapse in this market, sending the British pound reeling.

While that does seem to be a bit dramatic, the reality is that the US dollar is strengthening against almost everything, so the British pound should not be any different. The significance of this breakdown is something that you should be paying attention to, due to the fact that there has been a descending triangle forming, and now we have sliced through the bottom of the support level. The 50-day EMA is starting to reach lower to aim towards the 200-day EMA, thereby forming a potential “death cross.”

While I am not a big fan of trading the death cross just simply to trade the death cross, the reality is that the signal is followed by a lot of traders out there, and it is likely that the signal kicking off will add even more downward pressure to this marketplace. If we break down below the 1.35 handle, the market is likely to go looking towards the 1.3250 handle, and then possibly even a move down to the 1.30 level. This is all about the US dollar, not necessarily the British pound, but the fact that the UK economy has to deal with a lack of petrol certainly is not going to help the situation.

If we turn around and break out above the 200-day EMA, that could change some things, but obviously that would take a rather significant spike. It would be a major shift in the overall attitude of the British pound as well, so I do not necessarily expect that to happen. Obviously, if it does turn around like that though, you would have to pay close attention to it. The market continues to be very noisy, but obviously very negative at this point. The downtrend line above obviously could cause issues, but we are nowhere near there, so it is not even a thought at this point. Pay close attention to US yields, because if they continue to strengthen, that will continue to push this pair higher.