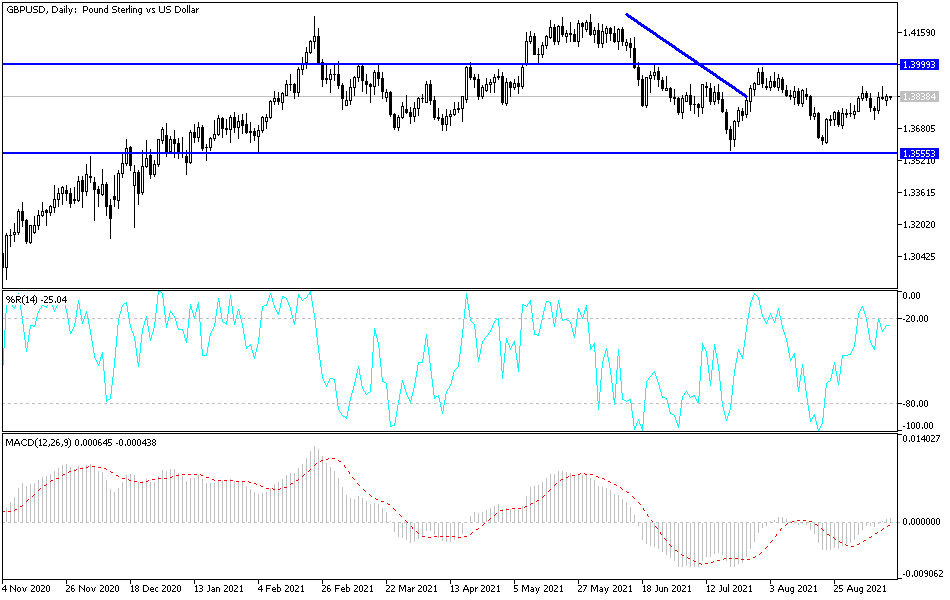

The British pound initially fell on Monday but then turned around to show signs of support. At the end of the day, we were hanging around the downtrend line, which is very important to pay attention to. If we continue to look at this chart through the prism of the 50-day EMA, then we are likely to see a lot of sideways action more than anything else. When you look at the last couple of attempts to break out, we have failed and ended up forming a couple of shooting stars.

Those shooting stars sit at the 1.39 level, which is an area that is a large, round, psychologically significant figure. The fact that we have seen a pullback from that area suggests that it is an area that is massively important. If we can break above the 1.39 level, then it is likely that we could go looking towards the 1.40 handle above. The 1.40 handle is an even more psychologically important level to traders around the world, and an area where we have seen selling in the past. However, if we were to break above the 1.40 handle, then it would be the clearance of a massive “W pattern”, which is 400 points tall. This is because the “double bottom” underneath is at the 1.36 handle, so a breakout above the 1.40 handle could open up the possibility of a move all the way to the 1.44 handle.

The shape of the candlestick does suggest that we have some buying pressure underneath, but this is a great way to get chopped up if you are trying to trade this market with any type of size. In fact, I would be very cautious until we get a little bit in the way of clarity, perhaps with an impulsive candlestick. We do not have one right now and I would anticipate that we will see more back-and-forth and hesitation overall. The attitude of the market continues to be one of “risk on/risk off”, so pay close attention to that as well, especially as the US dollar is considered to be a major “safety currency.” The Federal Reserve is supposedly tapering by the end of the year, so that should continue to put a little bit of a bid into the greenback, but obviously it is still a very fluid situation.