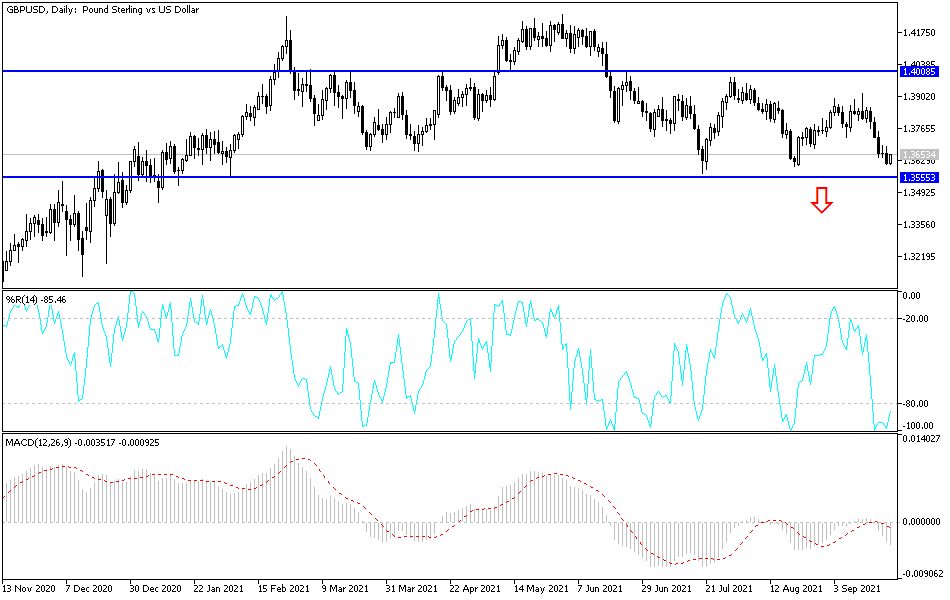

The British pound fluctuated on Monday, waiting for the FOMC. The 1.36 level underneath is major support, and if we can break down below that level, then it is likely that we could go looking towards the 1.35 handle.

If all of that does happen, this could be a huge sign of weakness, and a major “risk off attitude” type of situation. That would probably see the US dollar strengthen against almost everything, and it is likely that you would not only see this pair fall apart, but other pairs such as the EUR/USD will as well. Obviously, the market will continue to see a lot of concern about this uptrend line and the support levels underneath, but it must be said that when you look at the chart from a longer-term perspective, we have been grinding lower for some time, so it does suggest that perhaps we are eventually going to make the breakthrough.

To the upside, we would need to take out the 1.37 level at the very least to even consider trading to the bullish direction, but even then, I think the downtrend line above in the triangle will come back into the picture as resistance. The market would have to take out the 1.39 level for me to be confident about being long of the British pound, something that I just do not see happening anytime soon. Granted, we could get a little bit of a bounce from here, but at the end of the day I think the market has already made up its mind and it is only a matter of time before we get the catalyst to kick things off to the downside. Any move below the 1.35 handle would have this thing falling apart and probably reaching another 500 pips lower due to a bit of a trapdoor opening in the market. I still look at short-term rallies as potential selling opportunities, on signs of exhaustion.