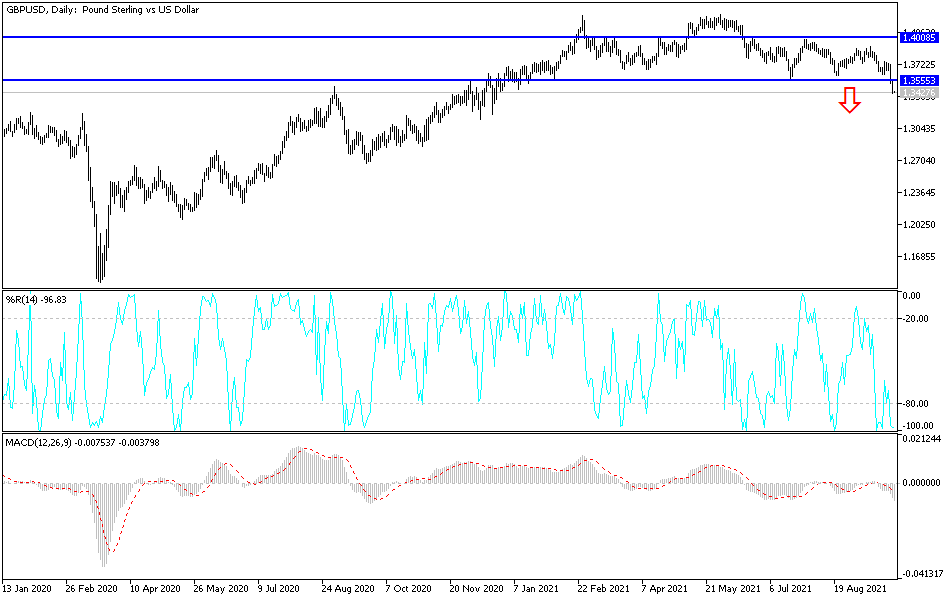

The British pound sold off quite drastically for the second day in a row, slicing through the 1.35 handle. This was an area that I thought was rather crucial, and the fact that we are below there says that we should see sellers on those rallies in order to get short yet again. The US dollar has been strengthening quite drastically, and that is going to cause quite a bit of negative pressure here. In fact, when you look at the overall picture, we are in a descending triangle, and that does suggest that we are going to kick off a move underneath.

The size of the candlestick is rather impressive, and that does suggest that we are going much lower. The market is more than likely going to go looking towards the 1.3250 level underneath, which is the next target, and then eventually we could go down to the 1.30 handle. That is a large, round, psychologically important level that a lot of people will be paying close attention to. We are getting ready to see a serious attempt to the downside. After all, the market rallying at this point will only offer “cheap dollars”, so we could see more pressure.

The 50-day EMA is starting to slope lower from here, perhaps getting ready to break down below the 200-day EMA. That is the so-called “death cross” that a lot of people will be paying close attention to. This is a market that I think continues to go lower and looking for opportunities to get short yet again will be the way going forward. Keep in mind that the trend has really started to accelerate to the downside, so at this point I have no interest in trying to fight what is an obvious move. That being said, if we were to turn around and break above the 1.39 handle, then the market would recapture the overall uptrend, and could send this market towards the 1.45 handle above. The market is very unlikely to do that, but if it does in fact do so, this is a huge turn of events that a lot of people would be attracted to; but again, it's very unlikely.