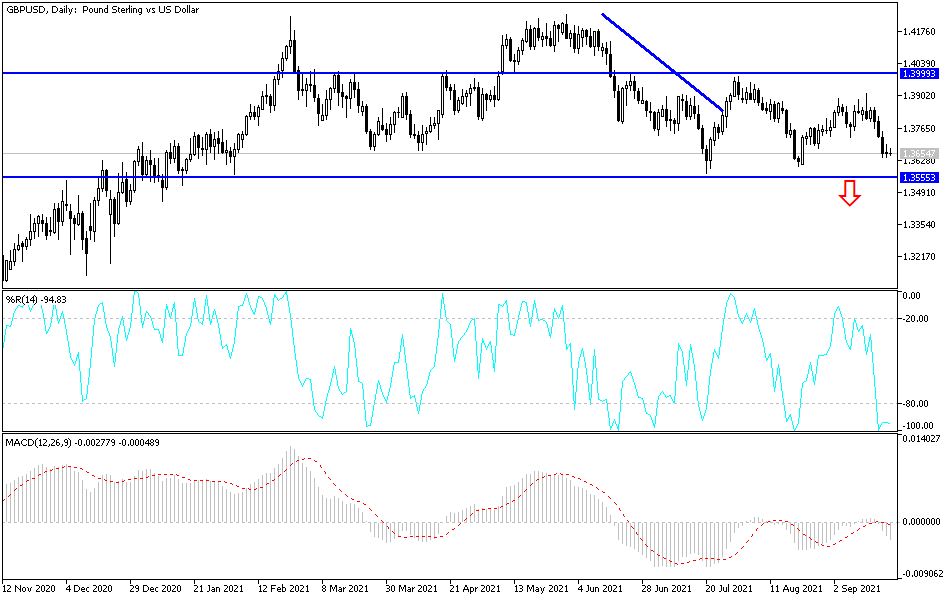

The British pound initially rallied on Tuesday but gave back gains near the 1.37 level to form a bit of an inverted hammer. If we break down below the 1.36 handle, that could kick off a lot of selling, and it should be noted that we are sitting right on top of an uptrend line as well. Nonetheless, this is a market that I think continues to see a lot of noisy behavior, and perhaps something that you should pay attention to is the US Dollar Index at the same time.

There are a lot of concerns around the world when it comes to any type of contagion in the banking system, as Evergrande continues to dominate the headlines. If we continue to see a lot of concern with risk appetite out there, then it is likely that we would see the US dollar pick up quite a bit of interest. That would be the case here as well, and it does not surprise me at all to see the British pound be a victim of the greenback as everybody goes running towards the US bond markets. In fact, the Tuesday session had seen a massive amount of demand for those very same bonds, suggesting that there are quite a few nervous traders out there.

Beyond the 1.37 level, we also have the 200-day EMA, and it certainly looks as if we are getting ready to see the 50-day EMA to reach down below the 200-day EMA, forming the so-called “death cross.” While I am not a huge trader of that signal, it attracts a lot of attention. In fact, I do not necessarily have a scenario in which I want to buy the British pound, at least not until we break above the 1.39 handle. If we do get above there, then obviously something will have changed.

When you look at the longer-term chart, you can see that we have been forming a large complex head and shoulders, and we might be getting ready to kick off the move to the downside. Obviously, we need to see a reason for the whole thing to kick off, but with all of that concern out there it would not be a huge surprise to see that happen over the next couple of days.