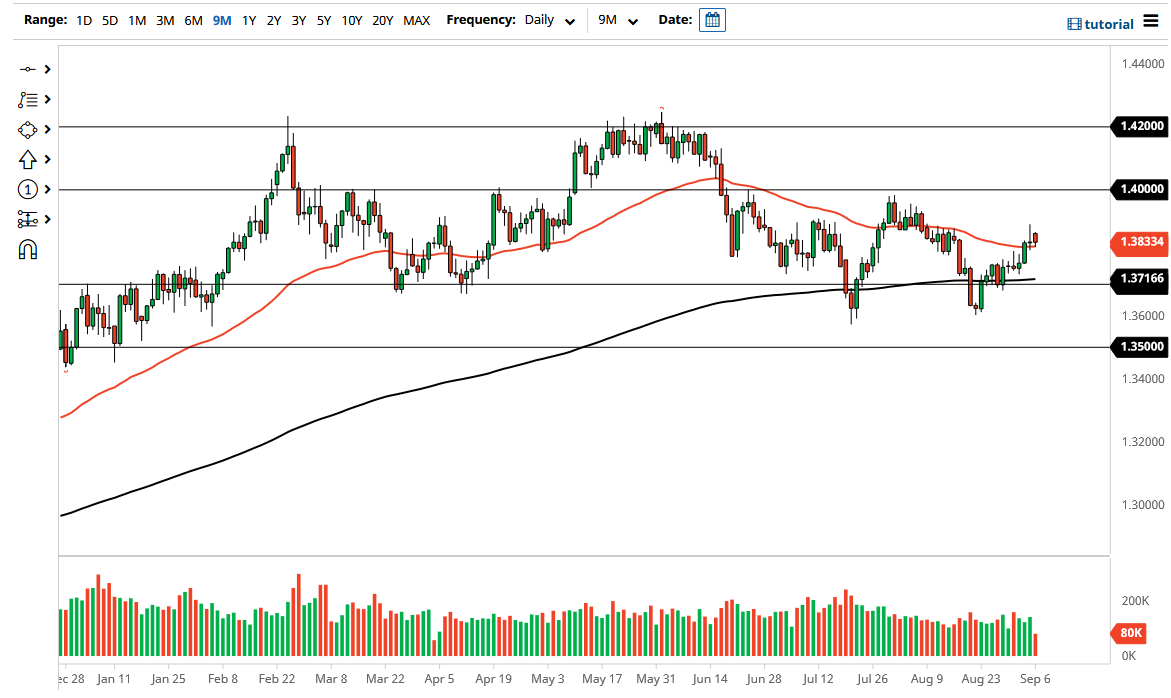

The British pound gapped higher during the open on Monday, only to turn around and fall apart. The 50 day EMA has offered a bit of support, so that is something to get positive about, but I do believe at this point in time this is a market that is going to be more or less a grind than anything else. When I look at the chart, this is a market that I think if we break down below the 50 day EMA, then we will probably consolidate in the same general malaise that had been defined by the 50 day EMA on the top and the 200 day EMA on the bottom.

If we can break above the top of the shooting star from the Friday session, it is very likely that we would see a significant move higher, perhaps attacking the 1.40 handle. That would be a “broken shooting star”, which is one of my favorite chart set ups as it not only is bullish due to the candlestick breaking higher, but the fact that it shows there are a lot of sellers that have just suddenly found themselves under water.

The British pound is getting a big boost from the US dollar in general, which has been weak across-the-board. That being said, you should keep in mind that Monday was also Labor Day in the United States and Canada, so the day was only about half as long as usual when it comes to liquidity. The real questions will be answered on Tuesday, as everybody comes back to work. At that point, we should have quite a bit more clarity as to where people really want to push this market. To the upside, if we clear that shooting star that I think it is likely that we go looking towards the crucial 1.40 level above, although it is probably going to be more of a grind towards that level than anything else. To the downside, if we do break down below the bottom of the shooting star from Friday, then I think we probably go looking towards the 200 day EMA underneath. Keep in mind that the 200 day EMA sits just above the crucial 1.37 level, an area that has been important more than once. Because of this, I think that there will be a lot of market memory there waiting for traders.