The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

There are a few strong valid long and short-term trends in the market right now, so it is a good time to be trading to take advantage of that.

Big Picture 5th September 2021

Last week’s Forex market mostly moved countertrend, but this was enough to push at least one major global currency to new long-term high closing prices against the greenback. Over the week, the New Zealand and Australian dollars were strong, while the U.S. dollar was weak. All the commodity currencies have generally been showing some strength. U.S. stock markets have also risen to new all-time high prices.

I wrote in my previous piece last week that the best trade was likely to be long of the NASDAQ 100 and S&P 500 indices. The NASDAQ 100 Index produced a gain of 1.45%, while the S&P 500 Index rose by 0.48% last week, producing an averaged gain of 0.97%.

Fundamental Analysis & Market Sentiment

The headline takeaway from last week was strong bullish movement made by the New Zealand and Australian dollars and weakness in the U.S. dollar and Swiss franc. U.S. stock markets rose. The key economic event of last week was the U.S. non-farm payrolls release which came in much weaker than had been expected, showing a net monthly gain of only 374k compared to the consensus forecast of 640k, which took the Fed’s QE tapering talk off the agenda.

Another noteworthy item was Australian GDP data showing that the economy is growing faster than expected, at 0.7% quarterly instead beyond the anticipated 0.5% increase. This may have helped boost the Australian dollar, which was already rising strongly.

The economic impact of the resurgent coronavirus globally driven by the delta variant also remains a concern to risk appetite as it causes problems with supply chains.

It is worth noting that U.S. stocks represented by the S&P 500 and NASDAQ 100 broke to new record high prices.

Next week will be dominated by monthly policy releases from the European Central Bank, the Bank of Canada, and the Reserve Bank of Australia. This is a full agenda, and it is likely that the Forex market will be considerably more active next week. We are already seeing considerably movement in the commodity currencies and all three of them (AUD, CAD, and the NZD) are likely to be affected by these releases.

Last week saw the global number of confirmed new coronavirus cases fall for the second consecutive week after rising for more than two months, with deaths also falling compared to the previous week for the first time in more than two months. Approximately 40.2% of the global population has now received at least one vaccination.

It seems to be becoming clear that due to the widespread Delta variant, which studies are beginning to show may be as easily transmissible as chickenpox, the only way to stop natural spread of the disease by “herd immunity” would be for more than 95% of an entire population to be fully vaccinated. There are also increasing indications that the effectiveness of vaccines wanes notably after approximately five months has elapsed from the last administration. These factors make even a local eradication of the coronavirus extremely difficult to achieve. Several nations have begun to administer third “booster” shots to ensure greater protection, especially for the older population.

The strongest growth in new confirmed coronavirus cases right now is happening in Albania, Australia, Austria, Azerbaijan, Barbados, Belarus, Belize, Bosnia, Bulgaria, Canada, Costa Rica, Germany, Israel, Jamaica, Latvia, Mongolia, Norway, Philippines, Serbia, Slovenia, the U.S., and Vietnam.

Technical Analysis

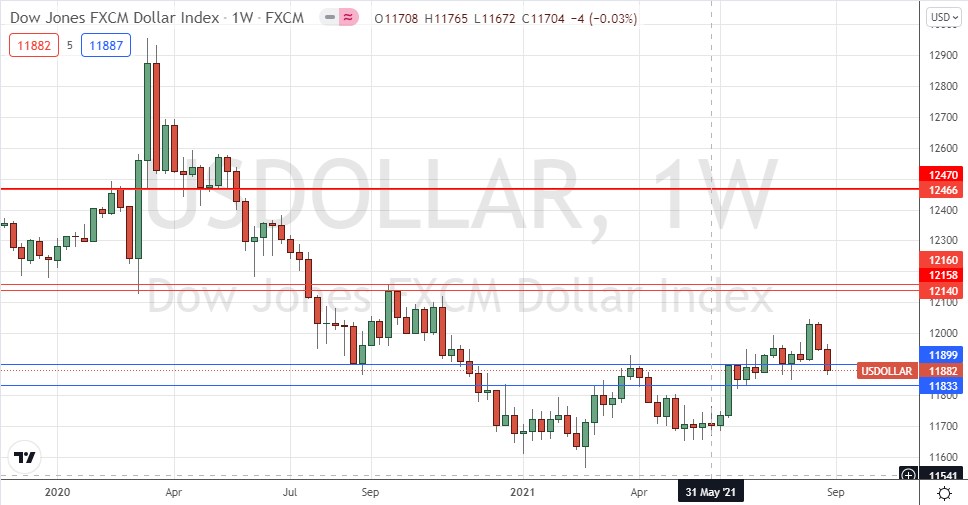

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a firm bearish candlestick last week which closed quite near its low. The price is still above the prices of recent weeks and well above levels from 3 and 6 months ago, which shows that the long-term bullish trend in the greenback is still valid. However, the short-term momentum is against the dollar, but on the other hand, the price has entered a zone which has been supportive in the past. This suggests that trades in the USD look relatively uncertain right now, so the best strategy in the Forex market may be to trade with momentum shown currently by other currencies, especially the New Zealand and Australian dollars.

NASDAQ 100 Index

The NASDAQ 100 Index printed a firm bullish candlestick which ended the week just a fraction below its record high price. Since the coronavirus crash of 2020, this major U.S. equity index has more than doubled in value, which is an excellent return over barely seventeen months. The NASDAQ 100 Index remains a buy.

S&P 500 Index

The S&P 500 Index printed a small bullish candlestick which ended the week just a fraction below its record high price. Since the coronavirus crash of 2020, this benchmark U.S. equity index has more than doubled in value, which is an excellent return over barely seventeen months. The S&P 500 Index is a buy.

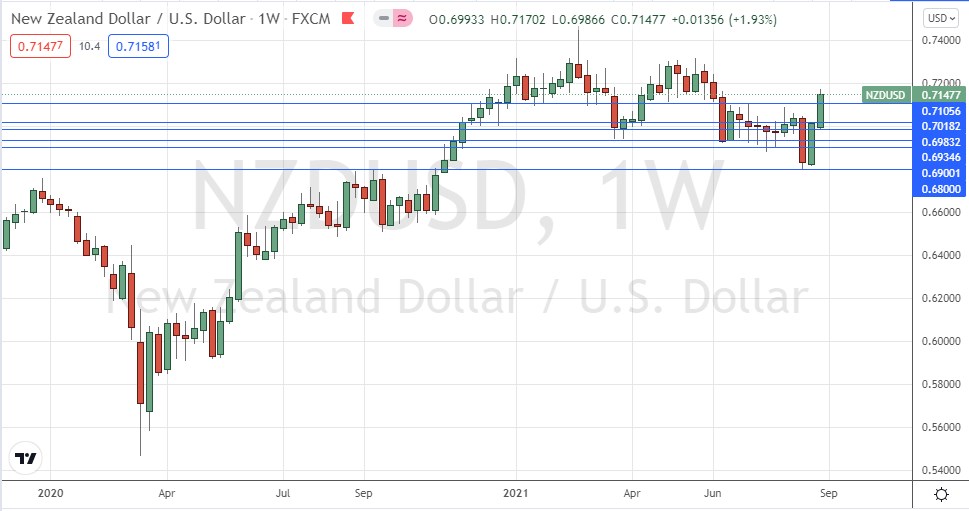

NZD/USD

The NZD/USD currency pair rose very strongly last week, rebounding from a long-term low price made just two weeks ago. This currency pair is showing the highest volatility in the Forex market right now. This was a strong counter-trend movement, but the price ended the week at a new 50-day high, so short-term Forex traders may be interested in finding short-term trends on lower timeframes in this currency pair to exploit in the direction away from the weekly open.

Bottom Line

I see the best opportunity in the financial markets this week as being long of the NASDAQ 100 and S&P 500 indices, and in short-term trades in the NZD/USD currency pair.