The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

There are a few strong valid long and short-term trends in the market right now, so it is a good time to be trading to take advantage of that.

Big Picture 19th September 2021

Last week’s Forex market mostly moved back in line with prevailing long-term trends, but overall, the price movement was relatively weak. Commodity currencies such as the AUD and the CAD, as well as the Swiss franc, fell while the USD and the JPY rose. Almost all global stock markets sold off during the week.

I wrote in my previous piece last week that the best trade was likely to be short of the AUD/USD currency pair taking a swing trading style. This was a good call as the AUD/USD currency pair fell by 1.18% over the week.

Fundamental Analysis & Market Sentiment

The headline takeaway from last week was a continuation of the souring in risk appetite that was manifested by falls in most stock markets and commodity currencies and rises in the USD and JPY. The risk-off sentiment has probably been driven mostly by fears that the US is not managing to really get a grip on the coronavirus and that the consequences of this threaten economic growth to some extent. However, there were some positive economic data releases last week, which showed US inflation cooling and retail sales rising, while British and Canadian inflation data came in slightly higher than had been expected.

This week will be dominated by monthly policy releases from the central banks of the US, the UK, Japan, and Switzerland, plus monetary policy meeting minutes from the Reserve Bank of Australia. This means that the Forex market is likely to be very active and volatile this week.

Last week saw the global number of confirmed new coronavirus cases fall for the fourth consecutive week after previously rising for more than two months, although deaths rose last week compared to the previous week. Approximately 42.9% of the global population has now received at least one vaccination. The US seems likely to approve Pfizer booster shots only for the over-65 age group.

It seems to be becoming clear that due to the widespread Delta variant, which studies are beginning to show may be as easily transmissible as chickenpox, the only way to stop natural spread of the disease by “herd immunity” would be for more than 95% of an entire population to be fully vaccinated. There are also increasing indications that the effectiveness of vaccines wanes notably after approximately five months has elapsed from the last administration. These factors make even a local eradication of the coronavirus extremely difficult to achieve.

The strongest growth in new confirmed coronavirus cases right now is happening in Albania, Armenia, Australia, Austria, Barbados, Belarus, Bosnia, Cambodia, Croatia, Egypt, Estonia, Israel, Latvia, Lithuania, Moldova, Montenegro, Philippines, Romania, Serbia, Singapore, Slovenia, and the Ukraine.

Technical Analysis

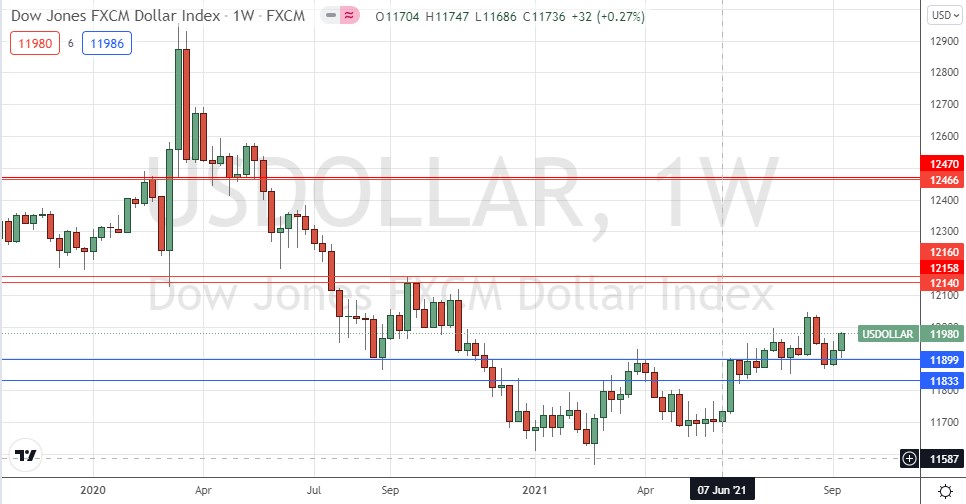

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a bullish candlestick last week which again rejected the zone of support which I have identified between 11899 and 11833. The price is still above the levels from 3 and 6 months ago, which shows that the long-term bullish trend in the greenback is still valid. We also have some bullish momentum evidenced by the fact that the weekly candlestick closed right at the top of its range. This suggests that trades in the USD look better on the long rather than short side right now, so the best strategy in the Forex market over the coming week will probably be to look for long trades in US dollar currency pairs.

AUD/USD

The AUD/USD currency pair fell firmly last week, printing a bearish candlestick that closed right on its low. This currency pair is showing the highest medium-term volatility in the Forex market right now. This was a movement in line with the long-term bearish trend, evidenced by the fact that the price is below its levels from both 3 and six months ago. As market sentiment has turned risk-off and the AUD has become a key risk barometer currency, there could be another good short trade opportunity here over the coming week. Waiting for the end of Monday’s market and then trading any breakdown from Monday’s range short could be a good approach here.

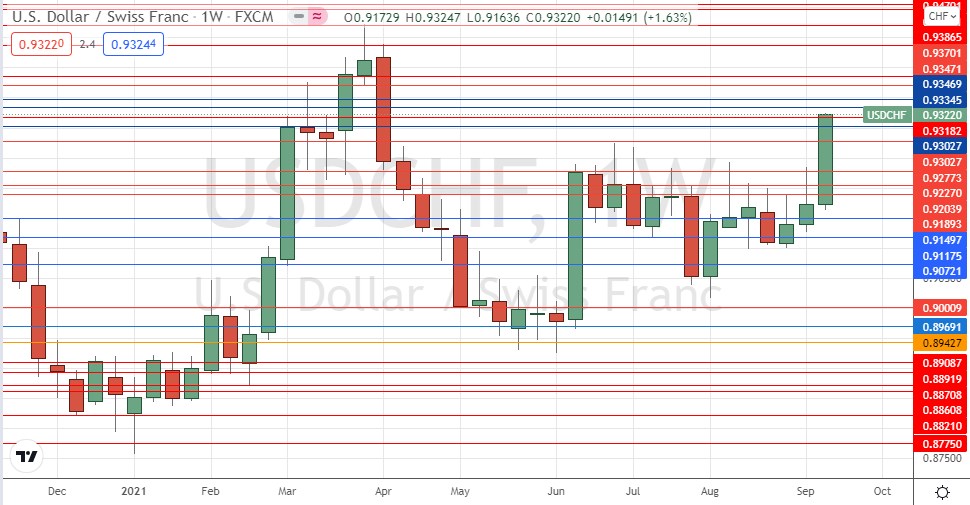

USD/CHF

The USD/CHF currency pair rose strongly over the final two days of last week, printing a bullish weekly candlestick that closed right on its high. This currency pair stood out in recent days as it broke to a new long-term high price. There could be another good short trade opportunity here over the coming week, but traders should be at least a little cautious as this currency pair does not tend to trade. Looking for long trades following shallow pullbacks on short-term price charts could be a great strategy for trading this currency pair, at least at the start of this coming week.

Bottom Line

I see the best opportunity in the financial markets this week as likely to be in swing trades in the AUD/USD currency pair, on the short side, and short-term day trades long in the USD/CHF currency pair.