Selloffs pushed the EUR/USD towards its lowest levels of 2021 as it moved to the 1.1668 support level and settled around the 1.1682 level as of this writing. The pair is awaiting developments to complete the current trend or rebound. Commenting on the future performance of the EUR/USD pair, in response to developments. In a note to clients, BNY Mellon said the results of the German elections at the end of the week are likely to reinforce the status quo and disappoint market participants "who are looking for a fiscal renewal in the country".

“Political stalemate is a force to be reckoned with,” says Geoff Yu, an expert at BNY Mellon. "The outcome of the German election will be disappointing for market participants and observers looking for fiscal renewal in the country.” German media have reported that both the Green Party and the pro-free market SPD are likely to join the SPD in a three-party coalition government.

According to Deutsche Welle, two options are on the table: either Olaf Schulz of the centre-left Social Democrats (SPD) steps in in coalition with the pro-free market Greens and Democrats (FDP), or a centre-right Christian Democrat. (CDU) ArminLaschet will get a chance to do just that. Ultimately, though, the main German parties in the SPD/CDU/CSU have collected more than half of the vote and can therefore join together and govern in a way similar to recent years.

For Yu, this represents a fundamental political deadlock.

The European Central Bank (ECB) has been tasked with stoking inflation back towards 2.0% on a sustainable basis, despite significantly cutting interest rates and bolstering its balance sheet through quantitative easing that has largely failed to reverse.

But the low interest rates offered in the Eurozone as a result of this policy means that the value of the euro has depreciated. Therefore, the issue of the euro's long-term value could ultimately fall to German politics given it is the largest economy in the bloc. The ECB is only priced by money markets to raise interest rates in 2024, at the earliest, given that Eurozone inflation appears set to fall below 2.0% over the medium term.

Meanwhile, the US Federal Reserve is expected to raise interest rates in late 2022 as officials express concern that current inflation levels are proving stubborn, creating a dynamic support for the dollar.

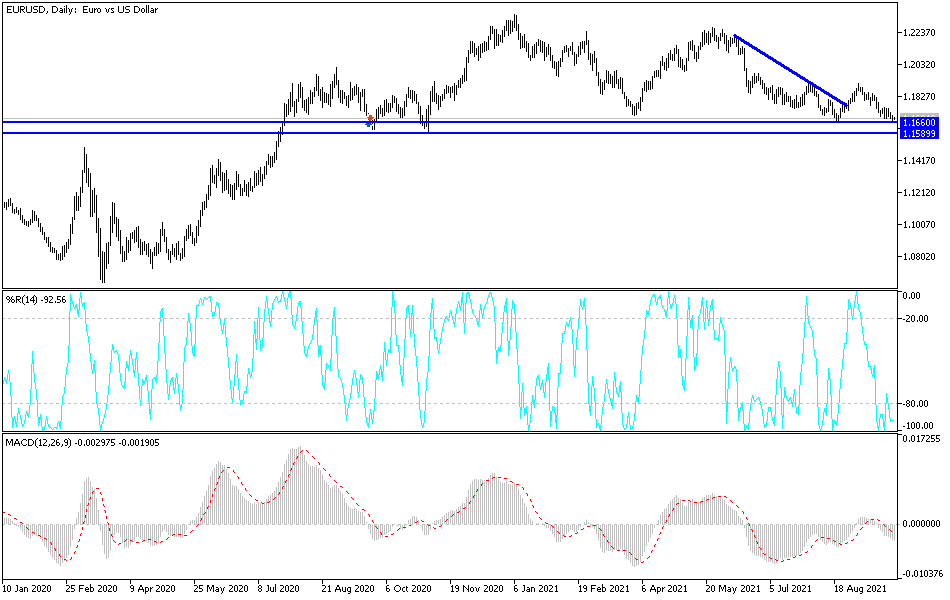

Technical analysis of the pair

On the daily chart, the general trend of the EUR/USD pair is still bearish, and as the pair hurtles towards its lowest levels of the year, the technical indicators are moving towards oversold levels. You can consider buying the currency pair below the support level 1.1620, and then wait for the rebound moment. On the other hand, to get out of the current bearish channel, the currency pair will have to move towards the resistance level at 1.1825 and then the psychological peak at 1.2000. The clear discrepancy between the economic performance and the future of monetary policy between the United States of America and the Eurozone is still a factor of constant pressure on the EUR/USD.

Today, the currency pair will react to Jerome Powell's and Lagarde's comments later today.