For three trading sessions in a row, the bears have been trying to push the EUR/USD to break the 1.1800 level, which paves the way for a stronger bearish breakout. The euro did not benefit from the European Central Bank (ECB)'s announcement of a slight reduction in the pace of bond purchases as part of one of its quantitative easing programs and hinted that further reduction could come in December. The euro was indecisive if not volatile in the wake of the September monetary policy decision, with the potential implications of the announcement that the Pandemic Emergency Purchase Program (PEPP) will buy European government bonds “at a somewhat lower pace” in the coming months than in the first half of the year.

The decision comes after months of strong market demand for government bonds across the board in Europe as well as elsewhere. This lowered government borrowing costs reflected through bond yields sharply before late August helped the European Central Bank maintain favorable financing conditions for European businesses, households and governments alike.

The quantitative easing adjustment was most notable in a set of policy decisions that otherwise saw interest rates charged or paid on major refinancing operations, leaving the marginal lending facility and bank deposit facility unchanged at 0.00%, 0.25% and -0.50%, respectively, with the original asset purchase program also set to continue at a pace of €20 billion per month.

Frankfurt has pledged to continue buying bonds under the PEPP program worth 1.85 trillion euros “until the end of March 2022 at least, and in any case, until it is decided that the phase of the coronavirus crisis is over.” ECB Governor Christine Lagarde said in a press conference following the decision that policy makers on the board will reassess the appropriate buying pace in December.

The European Central Bank's decision has taken an opportunity to effectively reduce, at least temporarily, the pace of growth of its footprint in the European government bond market in size each week. Lagarde's comments at the subsequent press conference suggest that another such step could now be taken by the end of the year if financial market conditions permit.

But the minor problem for the euro is that these steps extend the potential life of the stifling yield PEPP, which works in tandem with the European Central Bank's original €20 billion per month quantitative easing program known as the asset purchase programme. This creates room to continue buying bonds for some time beyond the March 2022 point at which many believe it will likely expire.

HSBC forecasts the EUR/USD exchange rate at 1.15 by the end of 2021, with a level of 1.14 set at the end of the first quarter of 2022 and a level of 1.13 for the end of the second quarter.

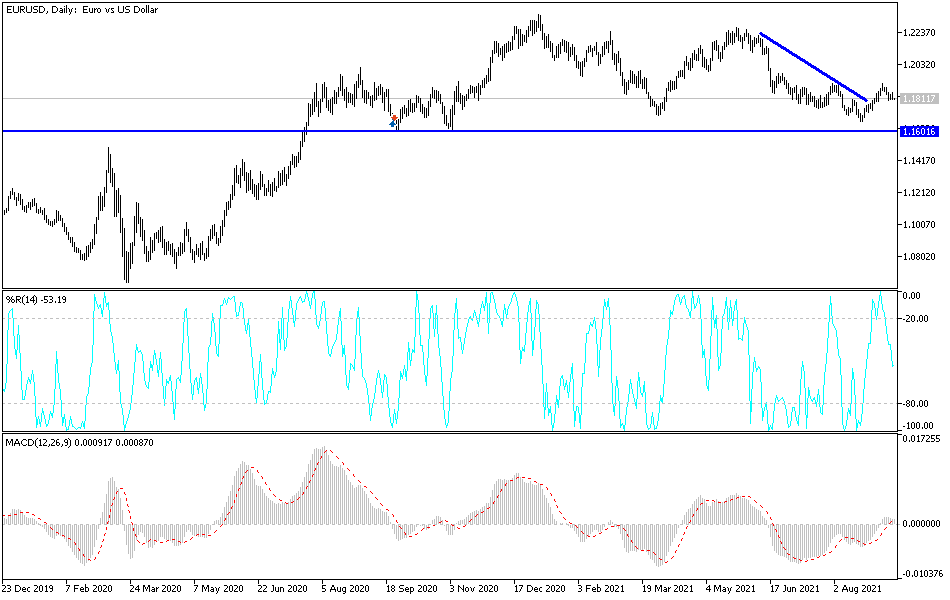

Technical analysis of the pair

The movements of the past week, a break of the bullish channel for the EUR/USD currency pair, and breaking the 1.1800 will all push the bears to move towards the 1.1780 and 1.1690 support level. The last level will push the technical indicators towards strong oversold levels, and it's a good level to consider buying. On the upside, the 1.2000 psychological resistance is still the most important for the bulls to continue to control the performance.

The EUR/USD is not awaiting any important US or European data today, so risk appetite will have the strongest impact on the performance at the beginning of this week's trading.