Bullish View

Set a buy-stop at 1.1820 and a take-profit at 1.1905.

Add a stop-loss at 1.1750.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.1790 and a take-profit at 1.1700.

Add a stop-loss at 1.1850.

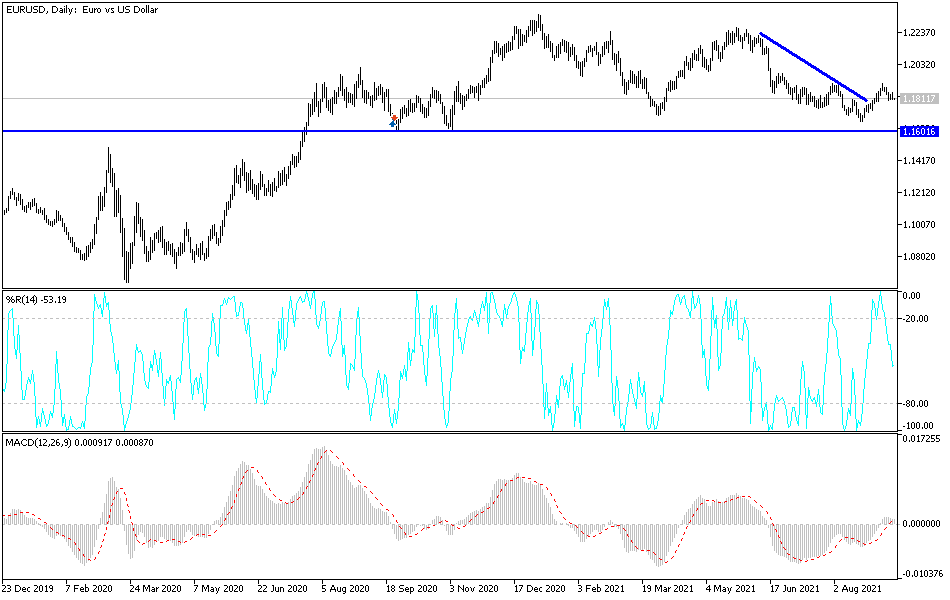

The EUR/USD pair is at a key support level ahead of the key US Consumer Price Index (CPI) data and as the Eurozone economic rebound accelerates. The pair is trading at 1.1810, which is slightly below last week’s high of 1.1900.

US Consumer Inflation Ahead

The biggest catalyst for the EUR/USD last week was the European Central Bank's (ECB) decision. The bank decided to leave interest rates unchanged. It also decided to slow gradually the amount of monthly quantitative easing (QE) purchases while Christine Lagarde maintained that the bank was not tapering.

The decision came at a time when the Eurozone is recovering at a relatively fast pace. The economy rose at a faster pace in the second quarter than analysts were expecting. At the same time, the region’s CPI rose by 3.0% in August, higher than the bank’s estimate of 2%.

Still, the Eurozone continues to face significant challenges ahead. The number of COVID cases is rising in most countries while supply bottlenecks are still around. This has affected some of its biggest companies like BMW and Mercedes, which are dealing with limited chips.

With no major economic data scheduled for today, the EUR/USD will react to the latest US CPI data scheduled for Tuesday. Economists polled by Reuters expect the data to show that the headline CPI declined modestly from 5.4% in July to 5.3% in August. The core CPI is expected to have moved from 4.3% to 4.2%. Still, these numbers are substantially higher than the Fed’s target of 2.0%.

The CPI data will come a few days after the US published its Producer Price Index (PPI) data. The PPI rose by 0.7% in August, lower than the previous 1% in July. This decline translated to an annualised increase of 8.3%, which was the biggest gain since 2020.

EUR/USD Analysis

The four-hour chart shows that the EUR/USD declined to 1.1810 last week. This was an important level since it was the highest level on August 13. The pair also struggled moving below that level several times last week. A closer look at the chart shows that it has formed a cup and handle pattern. The current level is part of the handle section. It is also slightly below the 25-day and 50-day moving averages.

Therefore, the pair will likely rebound as bulls target the key resistance at 1.1900. This view will be invalidated if it moves below the support at 1.1800.