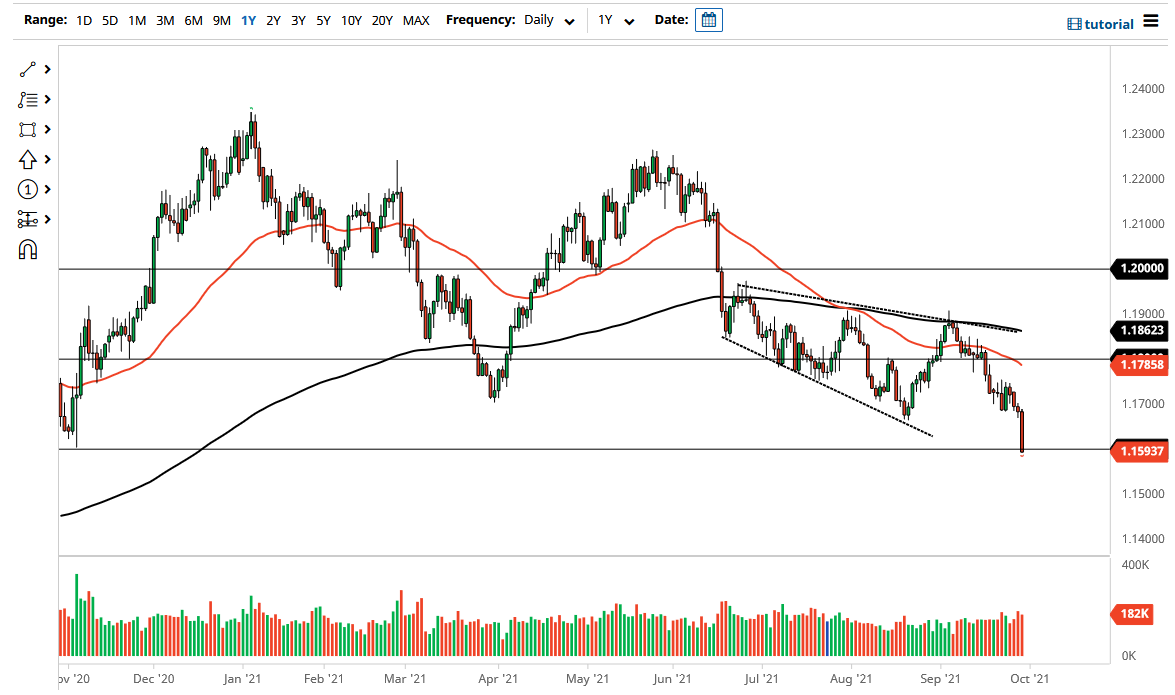

The euro broke down significantly on Wednesday to reach towards 1.16 level underneath. That is an area that has been massive support more than once, and the fact that we have collapsed during the day certainly suggests that we still have a lot of negative pressure in this market. The fact that the market has closed at such a low level also suggests that something has almost certainly changed at this point.

If we were to break down below the 1.16 level, then it is likely that we could go looking towards the 1.15 level. The 1.15 level is an area that I think will attract even more attention, as would breaking down that level. That being said, the market is likely to see a lot of noisy behavior, but at this point I think it is going to be easy to short this market at the first signs of trouble. In fact, it is not until we break above the 1.17 level that I would be even remotely interested in buying this pair. This is mainly due to the fact that it would be a major turnaround in momentum.

That being said, it does not look very likely to happen anytime soon, and I think that the market is going to continue to see a lot of choppy and noisy volatility. But the one thing that you need to pay close attention to is the 10-year interest rate, as it continues to see upward momentum, which makes the US dollar much more appealing than the euro. The market had been previously forming a bit of a megaphone pattern, but now it simply looks as if it is going to continue to drift lower.

When I look across the currency markets, the US dollar has been strengthening against almost everything, including the euro. In other words, correlation is starting to come together when it comes to the greenback, and I think that all of these other currency pairs continue to justify the idea of a stronger greenback. At this point, it looks like we have much further to go, but it is going to be very difficult to simply short right away. Looking for some type of exhaustion is the best way to go.