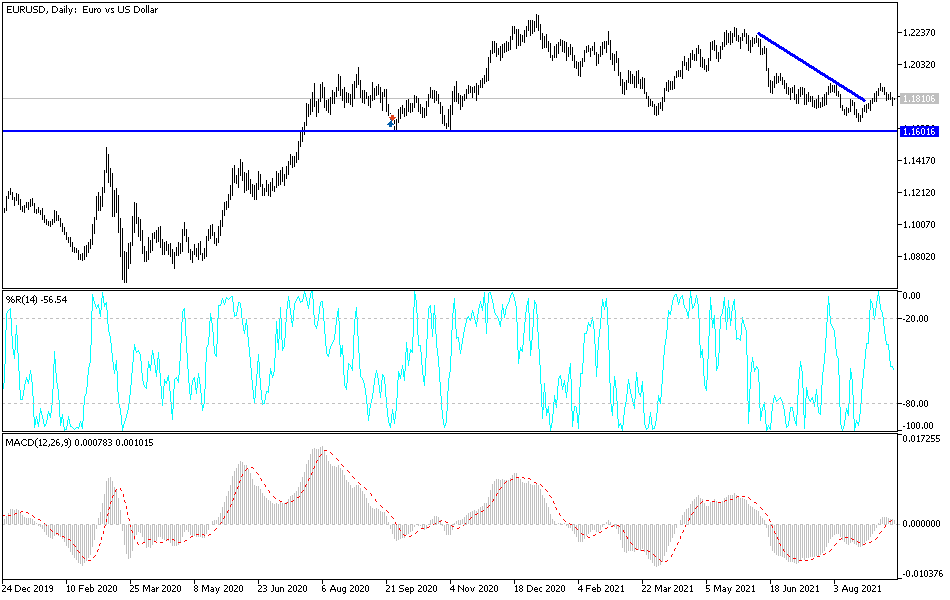

The euro initially sold on Monday, breaking well below the 1.18 level. We found a little bit of support near the 1.1775 handle, only to turn around and break back above the 1.18 handle. This is a market that has formed an inverted hammer that was followed by a typical hammer, suggesting that we are going to see a lot of back and forth in this general vicinity.

This should not be a huge surprise, because the 50-day EMA is sitting just above, and slicing through the market at roughly 1.2228 above. Furthermore, the inverted hammer that had formed during that session on Friday should offer resistance as well. Even if we break above there, then we have to look at the 200-day EMA as a significant resistance barrier. Although we could very well go to the upside from here, it is not until we break out above all of that resistance that we can get very long of the Euro.

On the other hand, if we turn around and break down below the candlestick on the trading session for Monday, then it could open up even deeper selling, perhaps a push towards the 1.17 level underneath. That would continue the overall megaphone pattern that we had been in, which typically means a lot of volatility. Because of this, I think you need to be very cautious with your position size, as the market is very likely to be choppy overall. Because of this, I expect a lot of fake outs in the next couple of sessions.

Both central banks are very weak when it comes to monetary policy, so I do not see anything changing as far as the choppiness is concerned. Nonetheless, the fact that we had formed an inverted hammer followed by a hammer suggests that we will get a bit of a “binary trade” over the next several days. If we can break out of that area, then it is likely that we could go higher or lower based upon that. Because of this, the market is one that you should be paying close attention to, for no other reason than the US dollar tends to move in the same direction across the Forex spectrum when it comes to using this is an indicator. If we fall here, then I will be looking to short the US dollar against multiple currencies. If we rise here, then I think the US dollar can be bought against several currencies.