The euro rallied again on Wednesday as we continue to see a lot of upward pressure. We are well above the 50-day EMA, which in and of itself is bullish, but you have to keep in mind that we are getting ready to get the jobs number on Friday, which has a major effect on markets. With this being the case, the market will continue to see a lot of noisy behavior, but I do think that the 200-day EMA above is what we really need to watch, which is roughly 40 pips above where we sit.

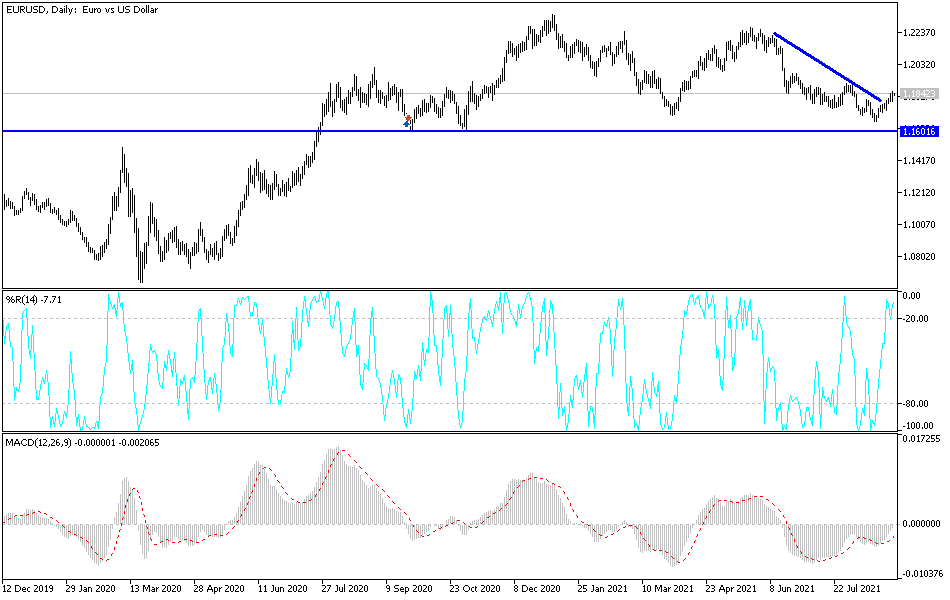

As long as we stay below the 200-day EMA, I still think there would be an opportunity to start selling on signs of exhaustion. On the signs of exhaustion, we could see this market turn around and drift lower. I am not suggesting that we are going to sell off drastically, just that we are more likely than not going to see a lot of choppy behavior. After all, both of these central banks are looking to taper, and that is something that you need to pay close attention to, as both currencies could strengthen as a result. We are in a bit of a downtrending channel still, and although this was a very positive move, the euro still cannot quite reach “escape velocity.”

If we can break out to the upside, then the market is very likely going to continue to go much higher, perhaps even reaching back towards the 1.20 handle. Regardless, this is a market that I think will continue to see a lot of noisy behavior, but ultimately will have to make some type of bigger decision. As things stand right now, be aware of the fact that risk appetite is going to have a major part to play here also. The US dollar is a safety currency, so any type of shock to the system could also move this pair lower. With that in mind, I like the idea of fading rallies until we break that 200-day EMA. If and when we do that, then I will become aggressively long, especially if we were to somehow break above the 1.20 handle, an area that I think would be a huge barrier.