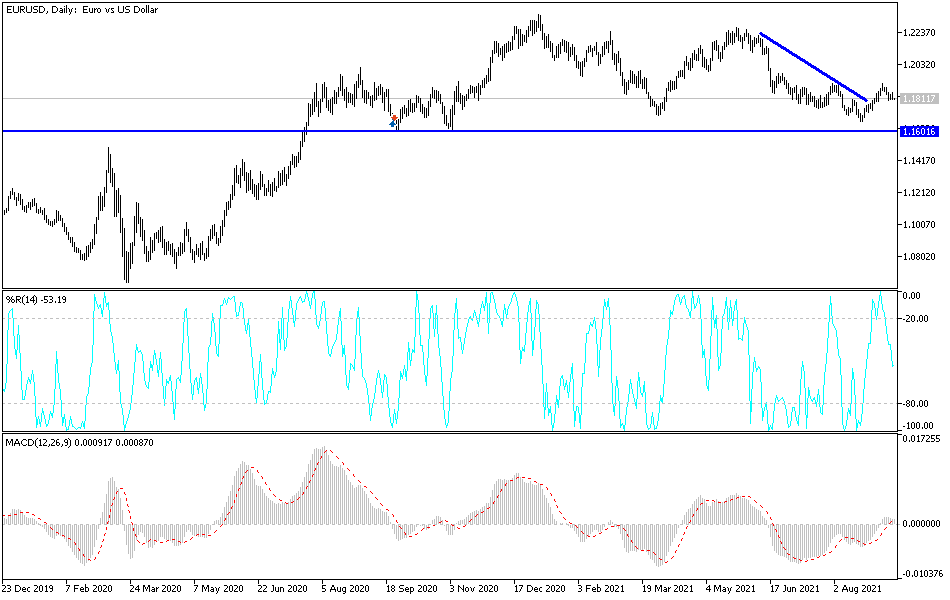

The euro initially tried to rally on Friday but gave back the gains to show a less-than-desirable finish for the week. As the market is sitting at the 1.18 handle, play breakdown below that level could open up fresh selling to send the euro towards the 1.17 level underneath. Furthermore, when you look at the candlestick pattern over the last several months, we are forming what is known as a megaphone pattern, which means that we have a ton of volatility coming our way.

The markets certainly are moving more or less on the U.S. dollar currently, and I think that's going to continue to be the case. The greenback continues to be the main driver here, after Christine Lagarde gave her speech a couple of days ago. Even though the European Central Bank is looking to taper slightly, at the end of the day the Federal Reserve is tapering a bit more. Neither central bank is currently looking to raise interest rates anytime soon, so in that scenario it makes sense that we would see a bit of choppy behavior.

In the present environment, it is probably likely that we will see a certain amount of risk aversion, and that typically means that people will buy US bonds. In order to buy those US bonds, they need to buy them with U.S. dollars. That drives up the demand for the greenback, which plays out quite nicely in this market. The fact that we have seen strength in the US dollar on Friday suggests to me that something is amiss out there, as this is not the only pair that I noticed had a complete turnaround. I believe that Monday is going to be crucial for the future direction of the US dollar, and by extension other currencies against it.

On a break below the 1.18 handle, I am willing to throw a small short position out there. However, if we see an extension during the day, I will more than likely add to that position so I can take advantage of what could be a bit of a swift move towards the 1.17 level, possibly even all the way down to the 1.16 level. As far as buying is concerned, I'm not as enthusiastic about doing so until we can get above the 200-day moving average.