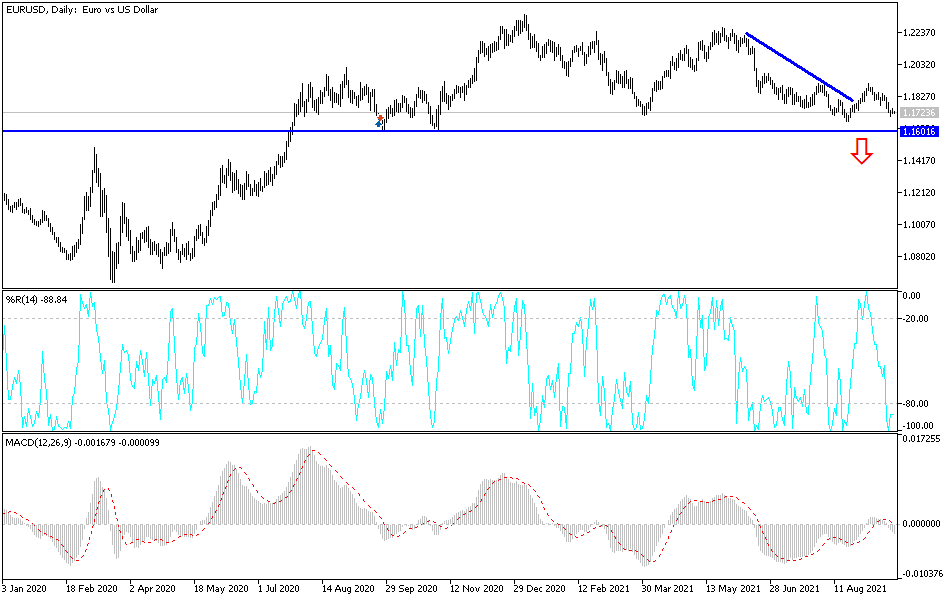

The euro initially rallied on Tuesday but has turned quite bearish by the end of the day to form a bit of a shooting star. This was preceded by a hammer, suggesting that we are going to hang around in this area in order to find some type of catalyst. At this point, it is very unlikely that we will see an easy trade, but it is obvious that there are a lot of things out there around the world that people are concerned about.

The 1.17 level is a large, round, psychologically significant figure that we continue to pay close attention to, and I think when we look at this market, we need to think about the fact that the big figure tends to attract a lot of volume. Furthermore, the US dollar is considered to be a “safety currency”, so you need to think also about how we are worried about a lot of things going on around the world, specifically in China when it comes to concern about overall credit markets. As long as there are concerns about contagion when it comes to the credit markets out there, a lot of people are going to demand US dollars in order to be cautious. Furthermore, those very same debts are denominated in US dollars, meaning that there will be yet another reason for demand.

If we break down below the bottom of the candlestick from the Monday session, then it is likely that we will go looking towards the lower levels, especially near the 1.16 level underneath. The 1.18 level above is an area that is resistance, right along with the 50-day EMA currently lower at that general vicinity. Because of this, it is very possible that the market may see a short-term bounce that only offers value when it comes to the greenback. As far as buying the euro is concerned, I have no interest in doing so until we get above the 1.19 level, or I see some type of massive support candlestick at a massive support zone. As things stand right now, I prefer selling rallies or break down below the lows of the Monday candle. I do think regardless of which direction we traveled, it is going to be choppy as per usual.