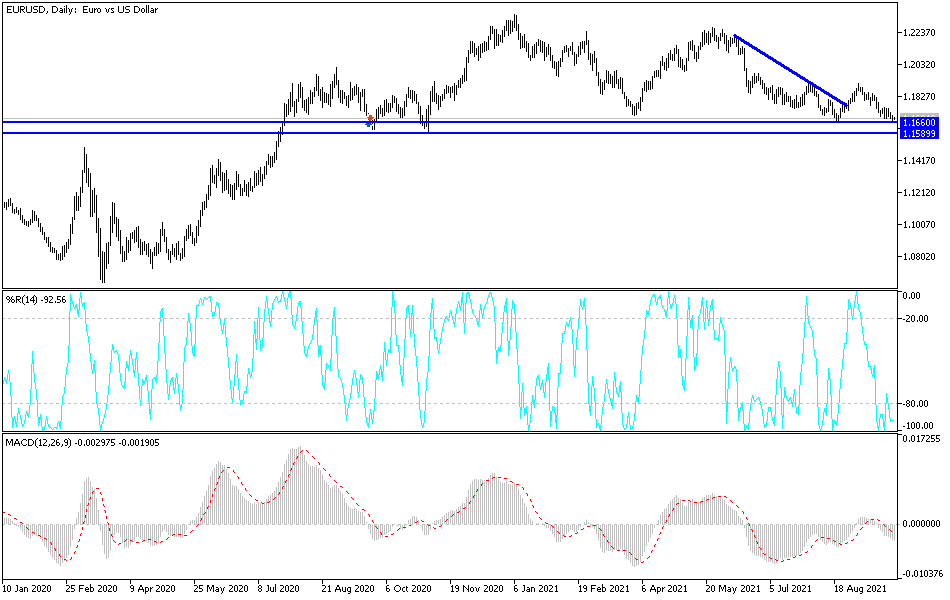

The euro fell again on Tuesday as we continue to see a lot of downward pressure. This is probably more due to the US dollar strengthening then it is the euro falling apart, but this is a trend that seems to be picking up momentum regardless of whatever the reason is. One of the biggest drivers of my opinion is going to be the fact that the interest rates in America are climbing, which makes a currency rather attractive. With this being the case, the market is likely to see an attempt to break down below the lows of the trading session on Tuesday, opening up a move down to the 1.16 level.

If we do break down below the 1.16 level, it is likely that the market will fall apart and go looking towards 1.15 level below. This is an area which, if broken, it is going to cause all kinds of issues for this pair. That being said, the market has been very choppy, so I think it makes more sense to simply try to short the market on short-term rallies that show signs of exhaustion.

The 50-day EMA is sitting at the 1.18 level and coasting lower. That suggests that the market is likely to find plenty of selling pressure above. The 50-day EMA certainly attracts a lot of attention, so I think you need to pay close attention to that indicator as it starts to approach price. Any break above the 50-day EMA could attract a lot of attention, perhaps reaching towards the previous downtrend line. Regardless of what happens next, this is a market that is going to continue to be very choppy and cause a lot of noisy behavior.

The interest rate differential between the two economies will continue to be a major driver of what is going on, just as the “risk on/risk off” attitude will drive this market. We have been very close to forming a bit of a short-term “double bottom”, going back to the month of August, so it will be interesting to see whether or not that actually plays out. Regardless, I think you need to be cautious with your position size, but as soon as we see a trade workout in our favor, we can add to the position size.