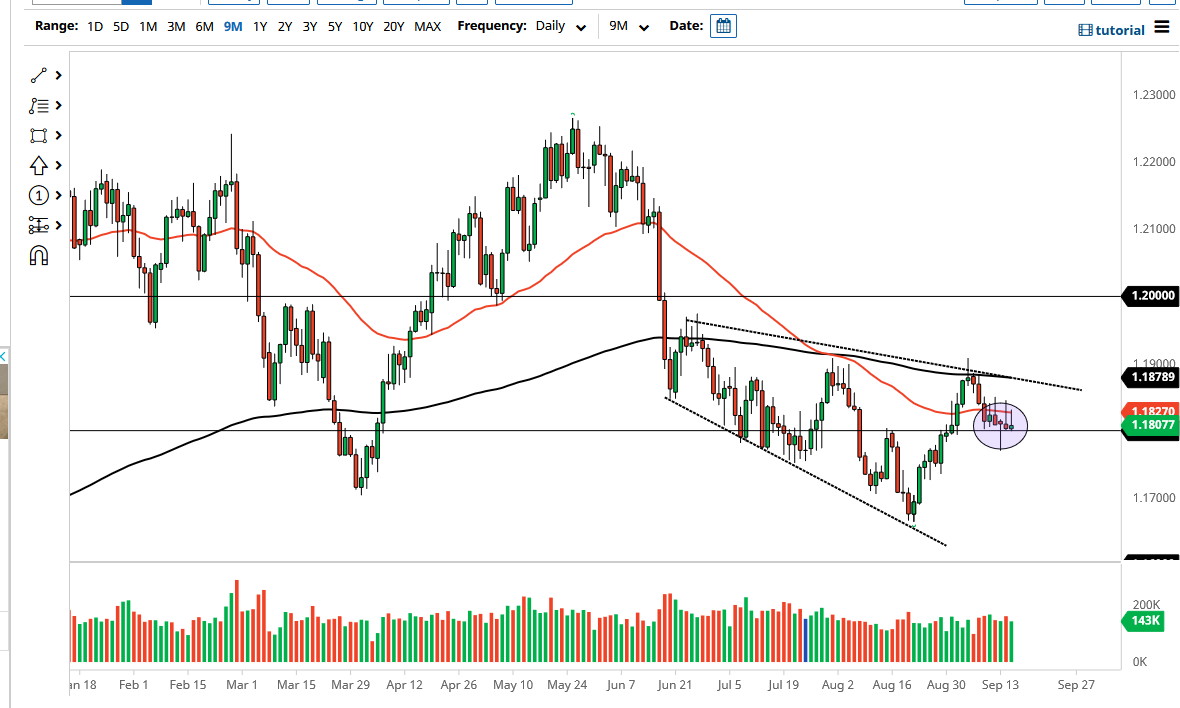

The Euro initially tried to rally during the trading session again on Wednesday but gave back gains to form a bit of a shooting star. The shooting star was contained by the 50 day EMA, as well as the range of the shooting star from the previous session. When you look at this chart, you can see this is clearly an area of interest, so I would not be surprised at all to see the market make a bigger move based upon this general vicinity.

The sequence of candles being a shooting star, hammer, shooting star, and yet another shooting star, suggests that the sellers are starting to take over a bit, but they have not completely wiped out the buying pressure. If we can break down below the hammer from the session on Monday, then I think the sellers will overwhelm buying pressure, opening up the possibility of a move down to the 1.17 level.

To the upside, the 1.19 level above is massive resistance, especially now that the 200 day EMA sits just below it. With that being the case, I think that we will continue to see a lot of selling pressure in that general vicinity. The market looks as if it is trying to get up the momentum to get moving, and right now I suspect that we are going to go to the downside, but obviously we need to see some type of catalyst. That catalyst could be the bond market, if for some reason the bond yields continue to rise. Ironically, if bond yields fall quick enough it is also possible that you could see the US dollar strengthen as well, because it would be a major sign that people are running towards safety, which in and of itself would mean the greenback also.

At this point, I think it is only a matter of time before we make the bigger move, and I fully anticipate jumping on board because as we had been choppy and volatile for quite some time, we will eventually get some clarity that allows this market to really get moving. Once that happens, as is typical with the Euro, we will often see a quicker move as the market suddenly shifts into one direction. Until then, I am going to slowly build up positions.