The Euro has gone back and forth during the trading session on Thursday as the ECB had a meeting and of course press conference, where they started to talk about stepping away from tapering just a bit, but at the end of the day they also signify that inflation may run a little hotter than anticipated for a while. This has sent the market into a bit of a tizzy during the trading session, but by the time it was all said and done we are essentially in the same little area that we had been in previously.

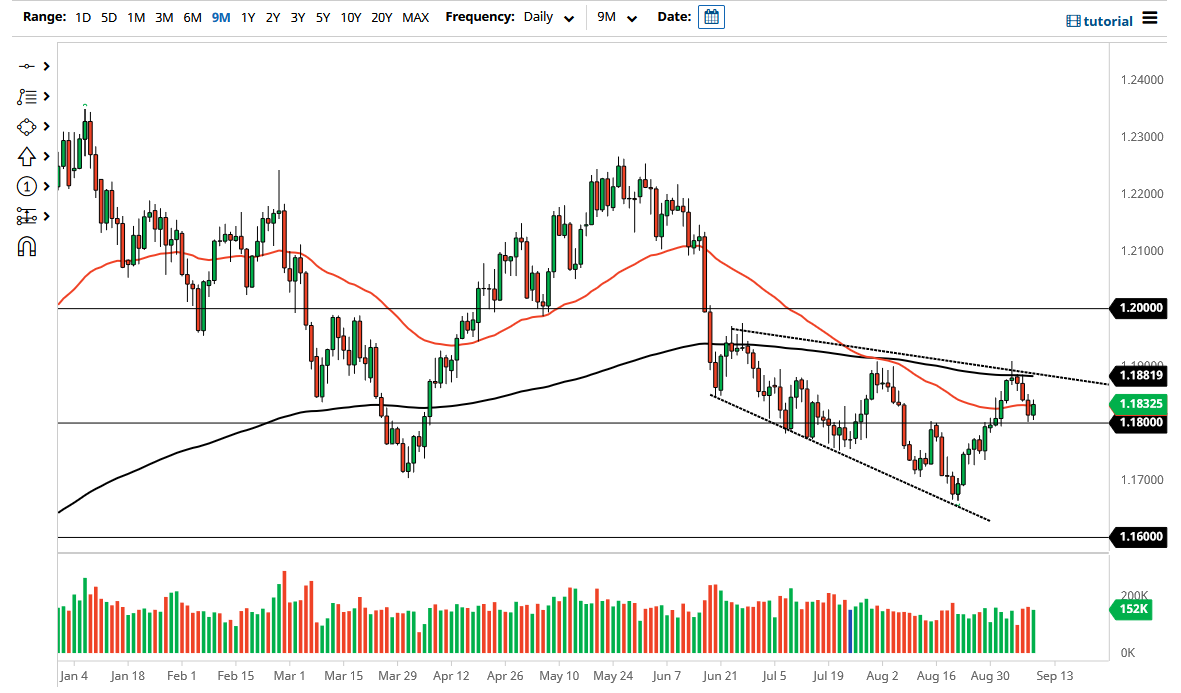

The 1.18 level underneath is an area that has been supportive more than once, as well as resistive. It is not a huge surprise that we have found a little bit of support in that region. The 50 day EMA has been slicing back and forth through the last couple of days, and therefore I think that what we can see is indecision. Furthermore, when you look at the chart of the last several months, we have formed a massive “megaphone pattern.” This shows the volatility is picking up, so now the question is whether or not we can rally or selloff?

If we were to break down below the 1.18 level on a daily close, then it is very likely that we go looking towards 1.17 level underneath. On the other hand, if we turn around and break above the highs of the last couple of days, then it is likely that we could go looking towards the 200 day EMA. It is worth noting that the Friday candlestick from last week was a massive shooting star that sits right at the 1.19 level. If we can break above that, then it is likely that this market goes higher, perhaps reaching towards the 1.20 handle next.

This is probably more based upon the US dollar than anything else, and with that being the case it is very likely that you need to pay close attention to the US Dollar Index. If the US dollar starts to lose strength, then by extension the Euro is more than likely going to rally. However, you should also notice that the US dollar strengthening in the US Dollar Index will put weight upon this pair.