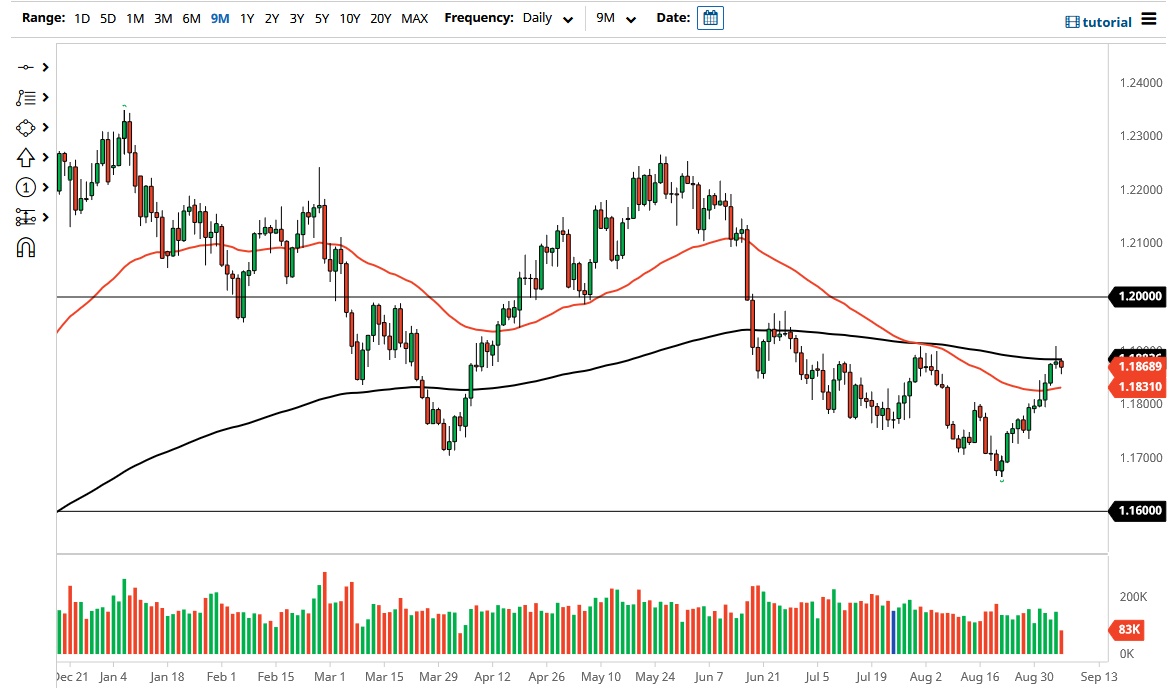

The Euro fell during most of the trading session on Monday, as the 200 day EMA has offered a somewhat significant resistance barrier. Nonetheless, this is a market that I think will continue to go back and forth in this general vicinity, trying to convince traders that it wants to go higher. At this juncture, we are probably a little overbought, but that is not overly surprising considering just how bullish we had been. Furthermore, the Friday candlestick was of course a shooting star and that will attract a certain amount of attention in and of itself.

When you see this chart, it is easy to tell that we have broken through a trendline and the last couple of trading sessions, so now one would anticipate that there should be buyers coming back in given enough time. As long as we can stay above the 50 day EMA, I certainly think there is a real possibility of picking up a little bit of value on these dips, letting the market tell you when it is time to get long again. With this, I think a lot of patients will probably be needed in order to take the trade, unless of course we turn around and slice through the top of that shooting star, which is coincidently just above the 1.19 level, an area that has been important previously.

You can see that we had formed the so-called “death cross” earlier, but quite frankly that is an indicator that is almost always late. In other words, by the time you see it form, the downtrend is almost over with. Because of this, I only recognize that as at best a tertiary indicator. The Federal Reserve has told us that not only are they going to be very slow about tapering bond purchases, but they have also made it known that a taper of bond purchases does not necessarily mean that interest rates are going to be rising right along with it. If that is going to be the case, then the US dollar will probably continue to suffer as a result. The candlestick for the Monday session was a bit of a hammer, but at the same time you should recognize that it was Labor Day in the United States and Canada, making it a less than ideal trading environment to begin with.