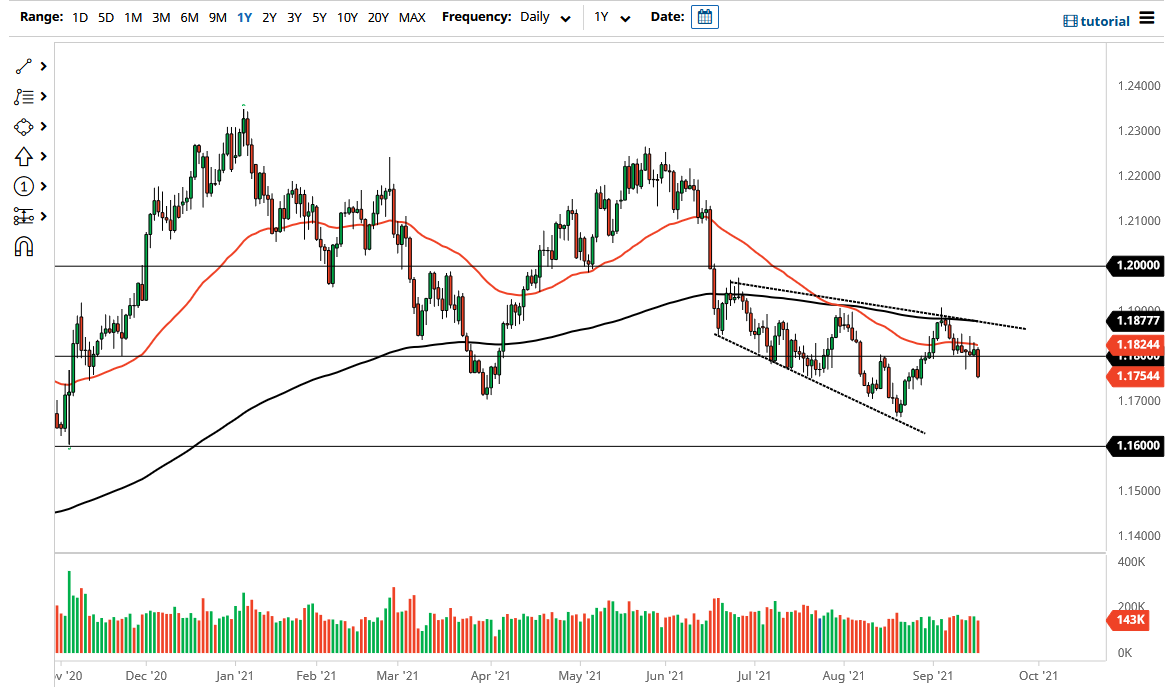

The Euro has broken through major support during the course of the trading session on Thursday as we have broken through the 1.18 level again. Furthermore, we even broke down below the 1.1750 level as well. Closing towards the bottom of the candlestick is of course a very negative turn of events and does suggest that we have further to go. Because of this, if we break down below the 1.1750 level, I will start selling again but I also recognize that we will probably have choppy behavior as per usual in this pair.

One of the biggest drivers of the market lower during the trading session was the US dollar picking up strength due to better than anticipated retail sales. This has traders out there wondering whether or not the Federal Reserve is going to taper earlier than they started to believe, and that of course makes the US dollar much more attractive. Higher interest rates in the bond market of course attract more money, and that drives up the value of the currency.

The Euro has broken down rather significantly over the last couple of days, and the fact that we are close to the bottom of the range tells me just how negative this pair has become. The 1.17 level underneath will continue to be a bit of a target, as it is a large, round, psychologically significant figure and an area where we have seen a lot of buying pressure underneath. If we break down below that level, then it is likely that we will see a move down to the 1.16 level which has been massive support over the longer term charts.

If we did turn around a break above the 200 day EMA, then it is possible that we will see buyers jump in and try to take this market out to the upside. That obviously would be a very strong sign and open up the possibility of a move to the 1.20 handle, which is an area that would attract a lot of attention as well. I think the one thing you can count on when it comes to this pair as the Euro tends to be very choppy in general. Furthermore, you have to pay close attention to the risk appetite of traders globally, as the US dollar tends to be thought of as a safety currency.