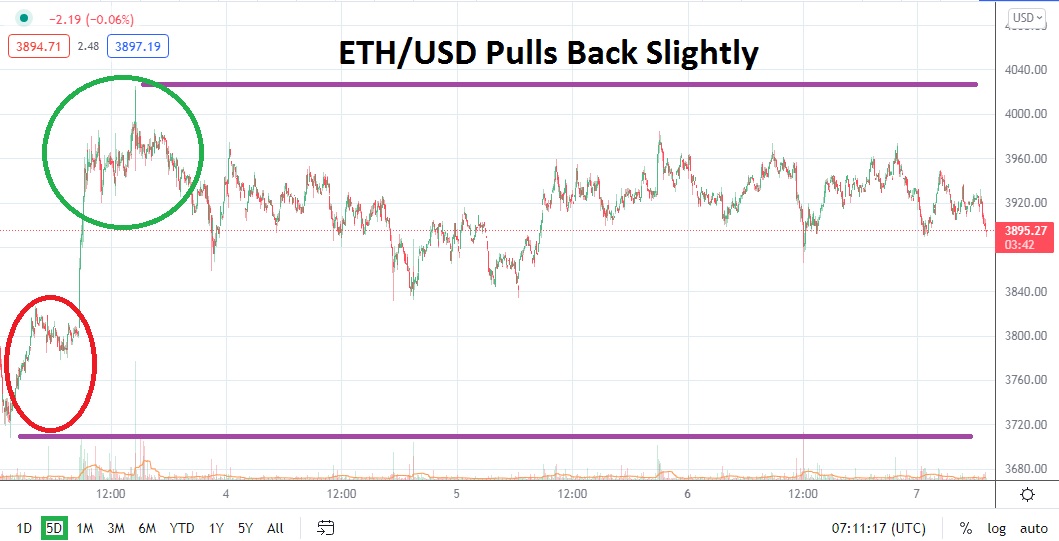

ETH/USD as of this writing is hovering slightly below the 3900.00 level, which is a great achievement via its mid-term trend after being at a low of nearly 1700.00 in the third week of July. ETH/USD has also managed to seriously flirt with the 4000.00 ratio the past handful of days and traded at a high of approximately 4025.00 on the 3rd of September. The all-time record high for Ethereum was near 4375.00 on the 10th and 11th of May.

The past few days of trading have seen consolidation build again in ETH/USD after achieving a mid-term high. The slight pullback in values has not been severe, but technical traders who have suffered from volatility within ETH/USD may have painful memories remaining from the turbulent bearish trend that essentially lasted from mid-May until the third week of July. While ETH/USD has certainly proven it can fly upwards, it has also demonstrated a capability to violently move lower when support begins to crumble.

Current support ratios may stir nervousness among some speculators and the 3845.00 mark should be watched. This level has proven somewhat adequate the past few days as a stabilizing zone and seemingly sparked buying. However if this juncture becomes vulnerable an important support level rests below around the 3825.00 ratio, if this price falters than downside pressure could certainly mount and it is conceivable that a quick test of 3785.00 could be targeted.

Before traders fear that all things are potentially negative for ETH/USD, fortunately the mid-term trend is actually expressing a rather impressive streak upwards. ETH/USD has compiled a serious winning streak and the slight reversals lower have failed to break any major support levels recently, meaning the climb higher for the cryptocurrency may not be done. Speculators who remain with a bullish perspective are likely still contemplating more buying positions.

If the 3900.00 mark is toppled and trading is sustained above this level, it may prove a solid moment to try and join the ETH/USD as a buyer. Yes, stop loss tactics must be used, but the recent advance of Ethereum upwards likely shouldn’t be challenged by those looking for steep reversals near term. Speculators may want to stay fairly aggressive with ETH/USD and pursue long positions with reasonable targets to try and cash out profitable trades if they materialize.

Ethereum Short Term Outlook:

Current Resistance: 3920.00

Current Support: 3845.00

High Target: 3985.00

Low Target: 3785.00