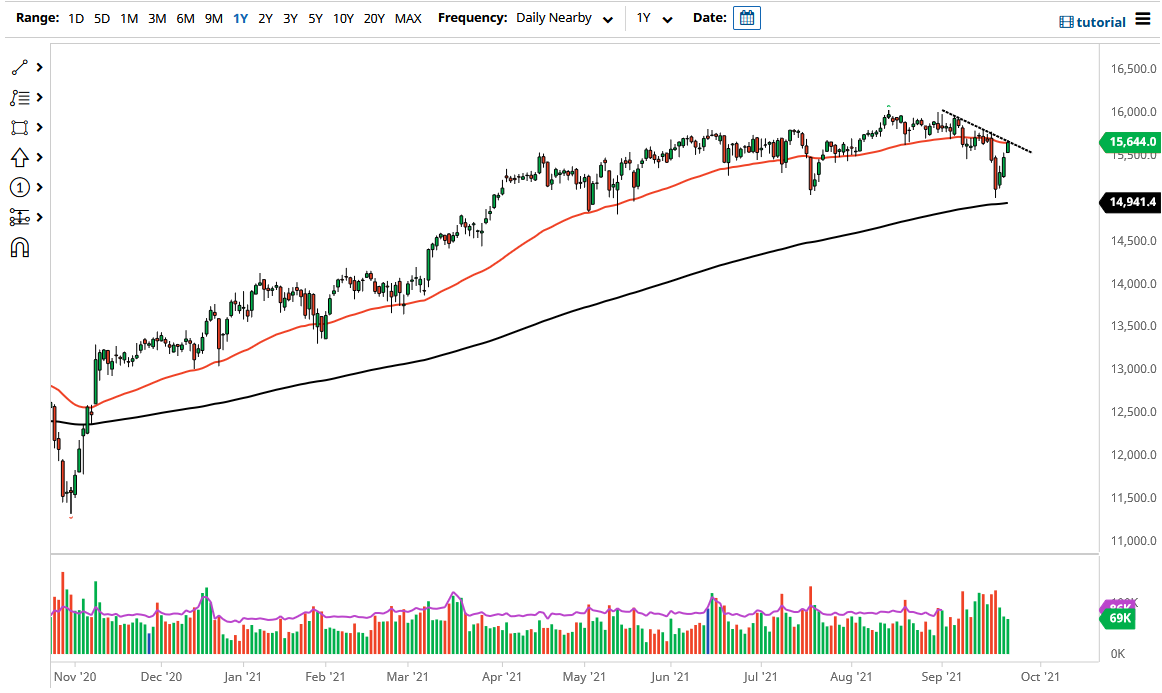

The German index has rallied significantly during the trading session on Thursday after gapping higher. The market then has rallied to reach towards the 50 day EMA and the downtrend line that are so prevalent in this market. If we can break above the downtrend line, then it is likely that the market could go much higher. That being said, if we can get a daily close above that downtrend line and the 50 day EMA, then I would be a buyer. In other words, I think I will be very cautious about getting involved in this market during the Friday session, because there is the possibility of a false breakout.

If the market does pull back from here, it is likely that we will continue to see downward pressure and could send this market looking towards the 200 day EMA. That being said, a lot of this will come down to whether or not people think that the economy is going to continue to strengthen worldwide. That being the case, the market is likely to continue to see it the German index as a way to play the idea of exports and global growth. However, if people start to worry again, then the DAX will almost certainly be sold into and therefore things could get ugly.

The Euro has rallied quite significantly during the trading session and that could work against the value of exports coming out of Deutschland as expensive German goods are very difficult to peddle around the world. However, if the Euro stays somewhat subdued, then it is likely that the DAX will get a bit of a boost right along with other indices around the world. After all, they all tend to move on two things: risk appetite in general, and of course monetary flows coming out of central banks. The ECB continues to be ultra-loose with its monetary policy, so they of course will keep the DAX afloat. That being said, it is worth noting that the ECB is not nearly as guilty of this as the Federal Reserve. Looking at this chart, it does seem like we are on the verge of a breakout, but we need a little bit of clarity, and I will see that at the end of the day on Friday, putting money to work on Monday if that does in fact happen.