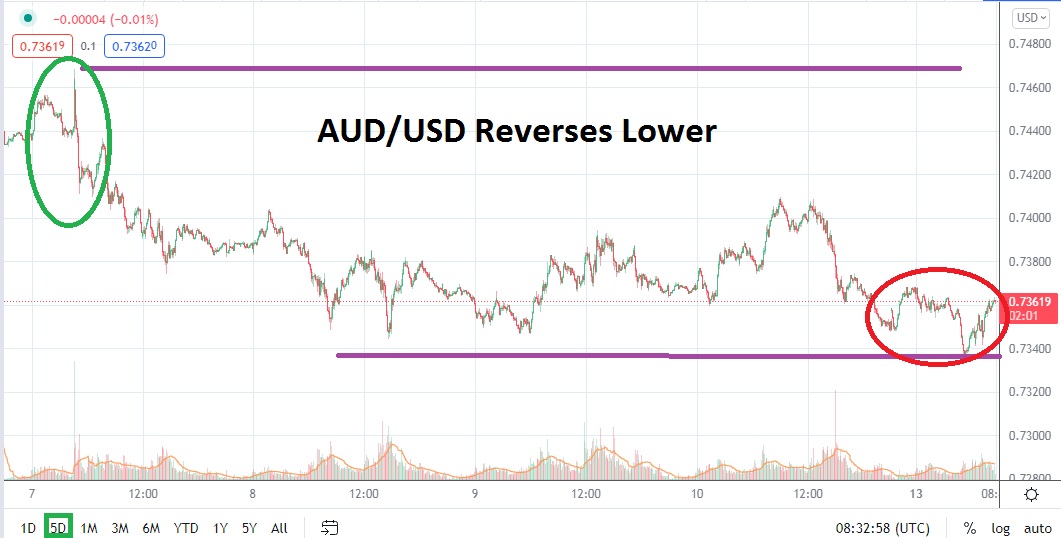

As of this writing, the AUD/USD is trading near the 0.73600 level. The Forex pair has seen a rather steady headwind blow since the 3rd of September when the AUD/USD was trading near a high of 0.74800, which essentially tested resistance not traded since the middle of July. The slight and incremental bearish momentum displayed within the AUD/USD the past week may be a technical reaction, but it is likely also experiencing some selling because of nervous sentiment which has crept into the global marketplace.

Intriguingly, as the AUD/USD tests its current support ratios and the level of 0.73500 looks to be critical, this could prove to be an important signal for speculators who suspect a reversal higher is about to be demonstrated. Technically, if current support levels are able to muster enough of a fight and sustain prices above, the AUD/USD could pick up a bit of positive optimism. If global equity markets turn in a calm day of trading particularly in the US, where futures markets in the major indices are showing that gains are expected later this could be a solid development.

Before suffering the slight headwinds and bearish trend which has chipped away at value within the Australian dollar the past week, the AUD/USD has actually enjoyed a capable bullish run higher after the 20th of August when a low of 0.71050 was legitimately tested. While the bearish track lower the past week has perhaps made traders with buying sentiment nervous, the results have not been devastating and the AUD/USD continues to remain within a solid price ratio.

In fact, the AUD/USD when taking a look at a six-month chart can be viewed as perhaps still within oversold territory. Economic conditions in Australia remain rather challenging as the nation is dealing with domestic effects from coronavirus lockdowns, but the AUD/USD has also shown signs of recent optimism and its slight downturn the past week may be a reflection of global market issues and not domestically based concerns.

Speculators who are considering a buying position of the AUD/USD near current support levels cannot be faulted. Certainly, traders need to use their risk management wisely. If support levels erode, further downside price action can develop. However, cautious wagers looking for upside within the current price range of the AUD/USD may prove to be a worthwhile opportunity.

AUD/USD Short-Term Outlook

Current Resistance: 0.73740

Current Support: 0.73440

High Target: 0.74040

Low Target: 0.73320