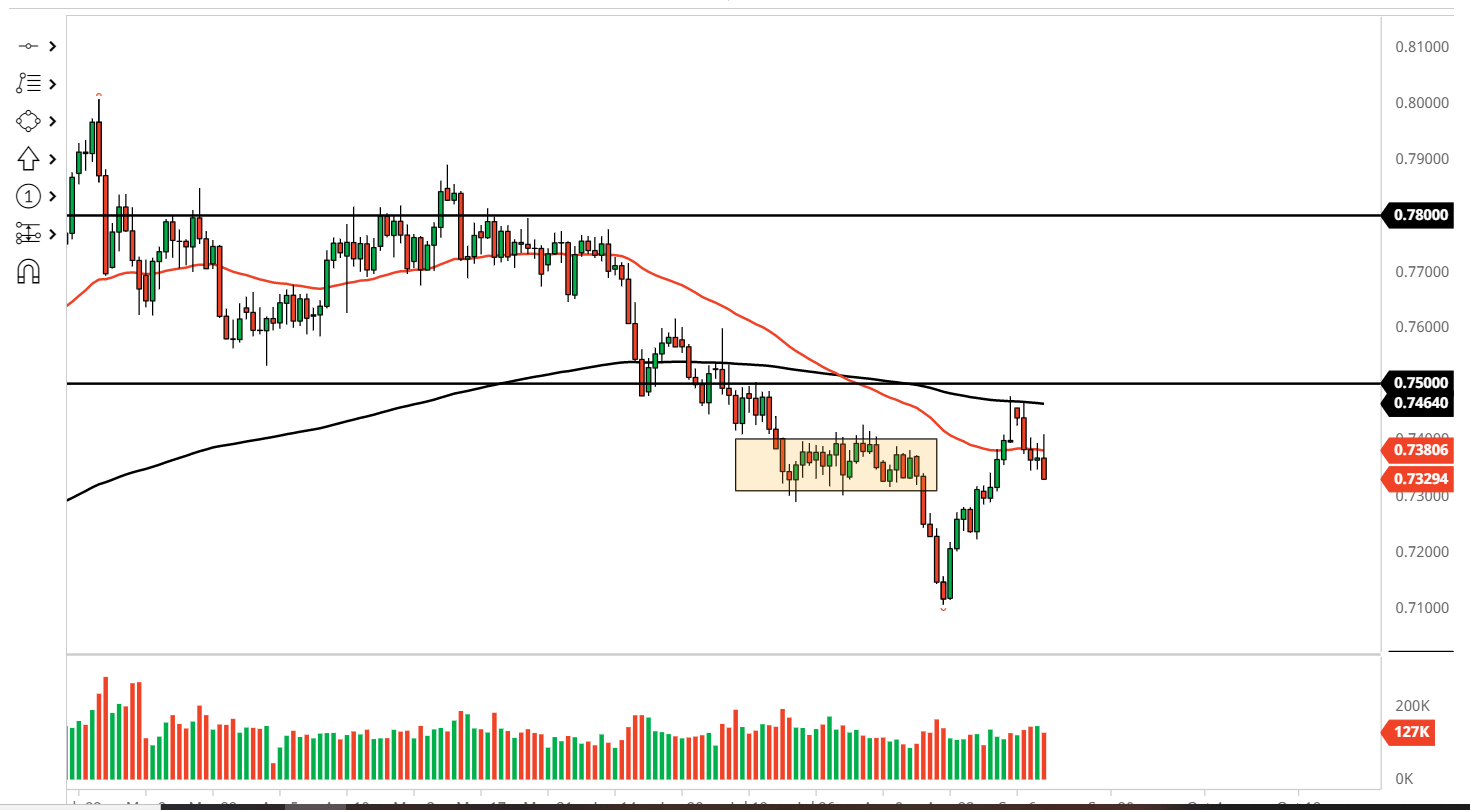

The Australian dollar initially tried to rally on Friday but gave back the gains rather rapidly. The 50-day moving average seems to be offering a significant amount of resistance, and it suddenly looks like a currency that's ready to fall apart. At this juncture, if we were to breakdown below the 0.73 handle, I think I would start selling again as it would almost certainly open up an attempt to get down to the 0.71 handle.

The Australian dollar is highly sensitive to the Chinese economy, and this is something that cannot be ignored. The Chinese economic numbers have been less than desirable as of late, and now there are concerns when it comes to credit in that country. As long as there are concerns about China, there are concerns about Australia. Beyond that, Australia has locked its own economy down quite drastically so one has to wonder how much longer that can go on without doing serious damage.

One of the things that has caught my attention more than anything else is that although the GDP numbers from Canberra were much stronger than anticipated, the reality is that we did not take off for a very long period. In fact, we have given up almost all of those gains and now look like we are ready to continue the overall downtrend. I suspect that the Australian dollar is probably going to be one of the weakest performers of the G10 currencies this coming week.

In order to start buying this market, I would need to see the Australian dollar break above the 0.7425 handle to get overly excited about going long. I think it's much more likely that we will break down below the 0.73 level on a daily close and I start selling. This will probably be seen as the U.S. dollar shrining across the board, so if we start to see the greenback pick up momentum against other currencies, that will give me yet another reason to get short of this market. One thing is for sure: the close of the Monday candlestick is going to be very telling as to where we are going next. What we have seen over the last couple of days has been very ominous.