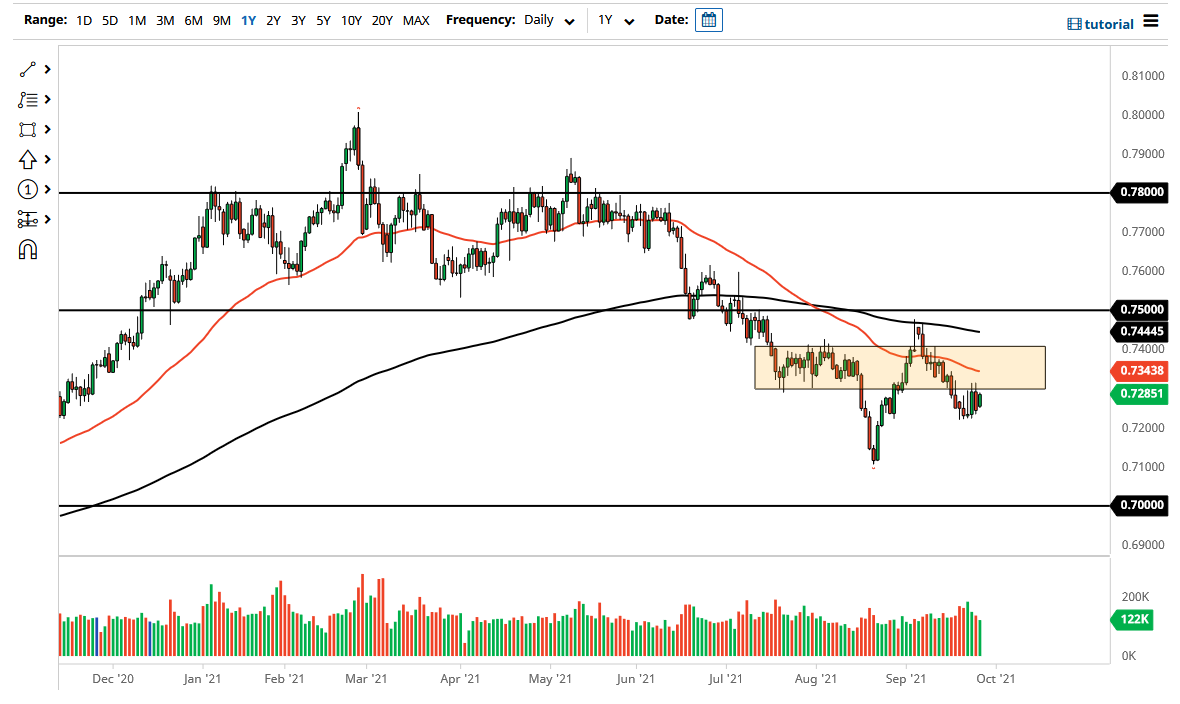

The Australian dollar has rallied a bit during the trading session on Monday to show signs of consolidation yet again. The 0.73 level above offers significant resistance yet again, and at this point in time it is likely that we continue to see sellers in that general vicinity. You can see that we have formed a couple of wicks above and have not dug back into them. The 50 day EMA is currently sitting at the 0.7343 level and going lower. That opens up the possibility of a “fade the rallies” type of situation, but the moves have been relatively small.

If we break down below the 0.72 handle, then the market is likely to go much lower, perhaps sending the Aussie down to the 0.01 handle. After that, then the market goes looking towards the 0.70 level underneath, which of course is a large, round, psychologically significant figure and an area that we have seen a big move.

To the upside, if we were to break above the 0.74 handle, then we could go looking towards the 200 day EMA and then possibly even the 0.75 level. The area above the current trading area seems to have a lot of resistance, and therefore that is going to be very difficult to get above all of that, but if we were to break above the 0.75 handle, then the market is likely to go much higher. However, it is going to take a significant amount of momentum to make that happen, and obviously a major shift in the attitude of the markets in general.

As interest rates in America continue to climb, the question is whether or not the bond markets provide a lift or a drag on the greenback. At this point, we are still very much to the downside and therefore I think that eventually the problems coming out of China and/or a slowdown in the global markets will continue to weigh upon the Aussie. This is a market that seems to rally during the North American session but sell off again during both Asia and Europe. Eventually, the bottom could very well fall out of this market because every time we do try to rally it seems like we struggle. Beyond that, we have so much in the way of noise above it is difficult to imagine that we simply go higher.