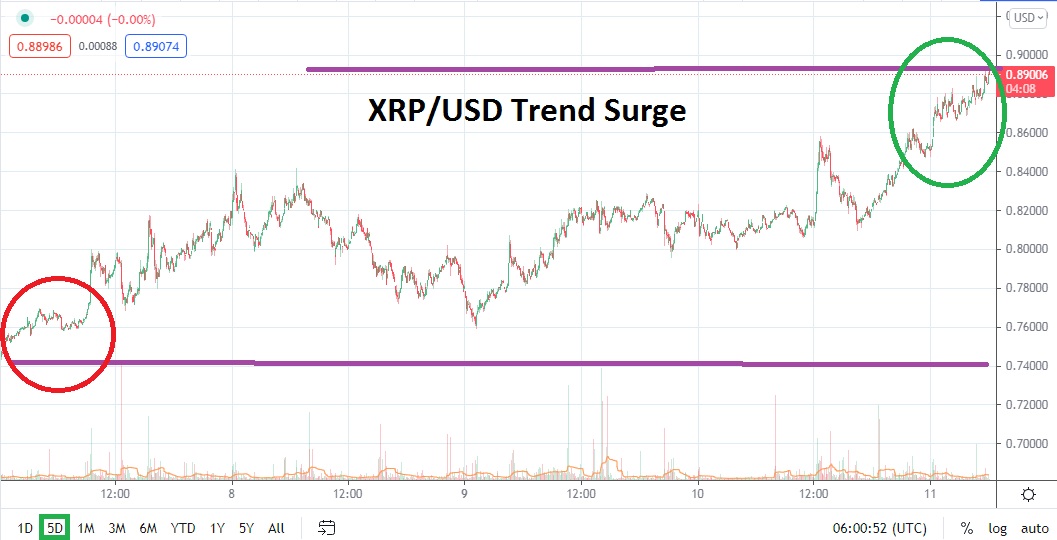

Since breaking the 77 cents resistance barrier and sustaining values above, XRP/USD has seen a steady progression of value added. However, after climbing to a high of nearly 84 cents on the 8th of August and then falling below the 77 cents barrier on the 9th, Ripple has sincerely added additional fuel to its trend and has climbed upwards in a quick manner. As of this morning, XRP/USD is challenging mid-June price levels as the cryptocurrency has danced in step with many of its major counterparts and correlated nicely with the positive momentum being displayed across the board.

On the 9th and 14th of June, XRP/USD traded near highs of 92 cents and speculators should keep this value in mind. While Ripple is still bouncing below the 90 cents level and resistance could prove difficult, if and when the juncture is punctured higher the 92 cents barometer could prove crucial. Speculators looking to buy XRP/USD based on the short- and mid-term trend cannot be faulted. Ripple has enjoyed a surge higher after hitting a low of nearly 51 cents on the 20th of July.

Serving as a warning on the 22nd of June, XRP/USD was also testing lows near the 51 cents mark. The cryptocurrency certainly is prone to violent reversals and traders shouldn’t dive into buying positions of XRP/USD without acknowledging violent downturns can be demonstrated abruptly which can be costly. However, as speculators also know, Ripple has a tendency to trend forcibly and when bullish cycles occur, the gains made within the speculative asset can be accumulated fast.

Timing the marketplace remains a difficult chore for many traders, particularly if they have used too much leverage and fluctuations of value make reversals that go against their intended direction challenge their assumptions. Speculators should use appropriate amounts of leverage which do not risk the bulk of their trading accounts. If a trader can manage their leverage and have realistic goals to cash out of the market, placing a wager on upwards momentum (or downwards) can produce solid results.

XRP/USD is enjoying an upwards trend and traders tempted to buy into the momentum cannot be faulted. Adequate stop losses should be used to protect against the pitfall of reversals. Support for Ripple near the 85 cents level does look attractive short term, and if it proves durable and the 90 cents juncture is punctured higher, June values which tested the 1.00000 mark are not out of the question near term.

Ripple Short-Term Outlook:

Current Resistance: 0.92900

Current Support: 0.85700

High Target: 0.99800

Low Target: 0.79900