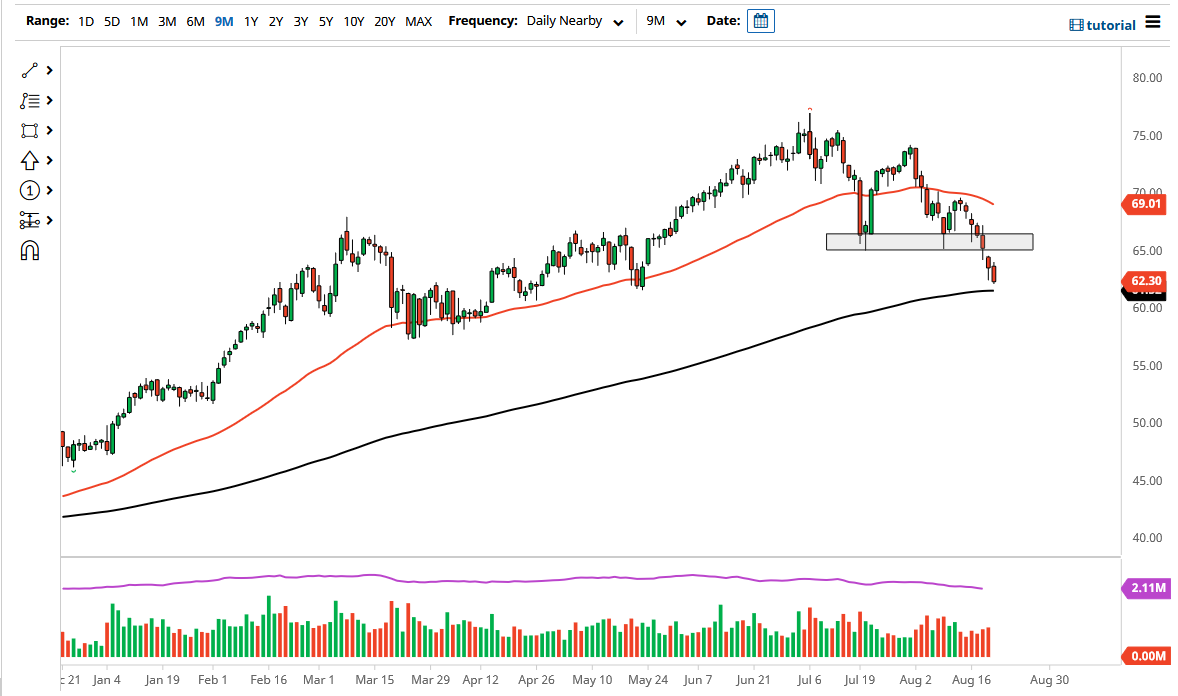

The West Texas Intermediate Crude Oil market fell again on Friday as we continue to see a lot of trouble when it comes to the idea of global growth. The 200-day EMA has offered a bit of support towards the end of the day, but when you look at this chart you can clearly see that the market looks very vulnerable, and that it could continue to go even further to the downside.

Presumably, there is probably going to be a significant amount of reaction to the 200-day EMA, because the algorithmic programs will certainly be paying close attention to that indicator. If we were to break down below the 200-day EMA, then the market is going to try and test the $60 level. The $60 level is a large, round, psychologically significant figure that a lot of people will be paying close attention to. That being said, the market is likely to continue to see downward pressure as we are closing towards the bottom of the candlestick, which of course does not bode well.

However, if we do bounce from here, it is likely that the $65 level would be significant resistance, not only due to the fact that it is a psychologically important figure, but it is also where we previously had seen support. “Market memory” would come into play at this point, and I would anticipate sellers jumping all over the marketplace if we show any signs of exhaustion in that area. Remember, we are starting to question whether or not there is going to be global demand, as we are starting to see signs of slowdown around the world. Keep in mind that even though OPEC chose not to increase oil production at the behest of Joe Biden, the markets continue to selloff.

If we were to turn around and break above the $65 level, then we need to pay close attention to the 50-day EMA above, because it could be a significant amount of resistance just waiting to happen. Breaking above that level would push this market much higher, perhaps reaching towards the $75 level. Nonetheless, I think that is less likely to happen anytime soon, and I think at this point we will continue to sell signs of exhaustion.