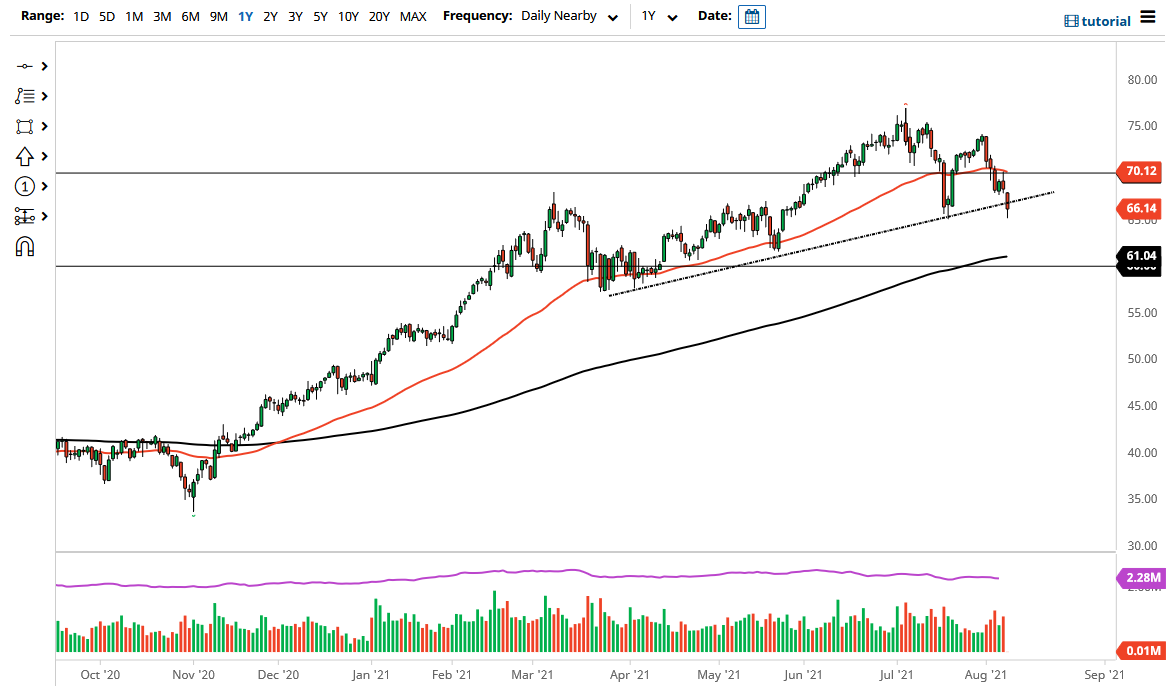

The West Texas Intermediate Crude Oil market found itself on its back foot Monday as there was suddenly a lot of negativity. With that being the case, it is worth noting that the $65 level has been supportive previously, and it is a large, round, psychologically significant figure. By holding in this general vicinity, the market is likely to see a bit of a fight going forward. That being said, the market is likely to see further pressure though, because we are starting to break down structurally.

While I do not necessarily think that it is time to start selling quite yet, if we break down below the $65 level then it is almost certain that the oil market will continue to go lower. Rallies at this point will continue to see the resistance near the $70 level as it is not only a large, round, psychologically significant figure, but it is also where the 50-day EMA currently sits and is turning lower. I think rallies at this point will show signs of exhaustion that traders will jump in and start pushing.

That being said, if we could get a daily close above the $70 level, then it could signify that we are forming a bigger “W pattern”, which would be a bullish sign, although technically it is not completely in play until we get above the $75 level. If we do break down below, then I think the 200-day EMA gets targeted, and then possibly the $60 level. Nonetheless, one thing that you should pay close attention to is that the most recent high was lower than the one before it, and now it looks as if we are trying to break down rather significantly. We are almost at the point where we have formed a “lower low”, which means that we could go much lower.

At this point, the market is likely to see continued problems, due to the fact that the trading public is now concerned about whether or not the Delta virus is going to slow things down, and whether or not we have reached “peak growth.” I do not know if we will recover, but we most certainly need to do so rather quickly if we are going to continue the overall uptrend.