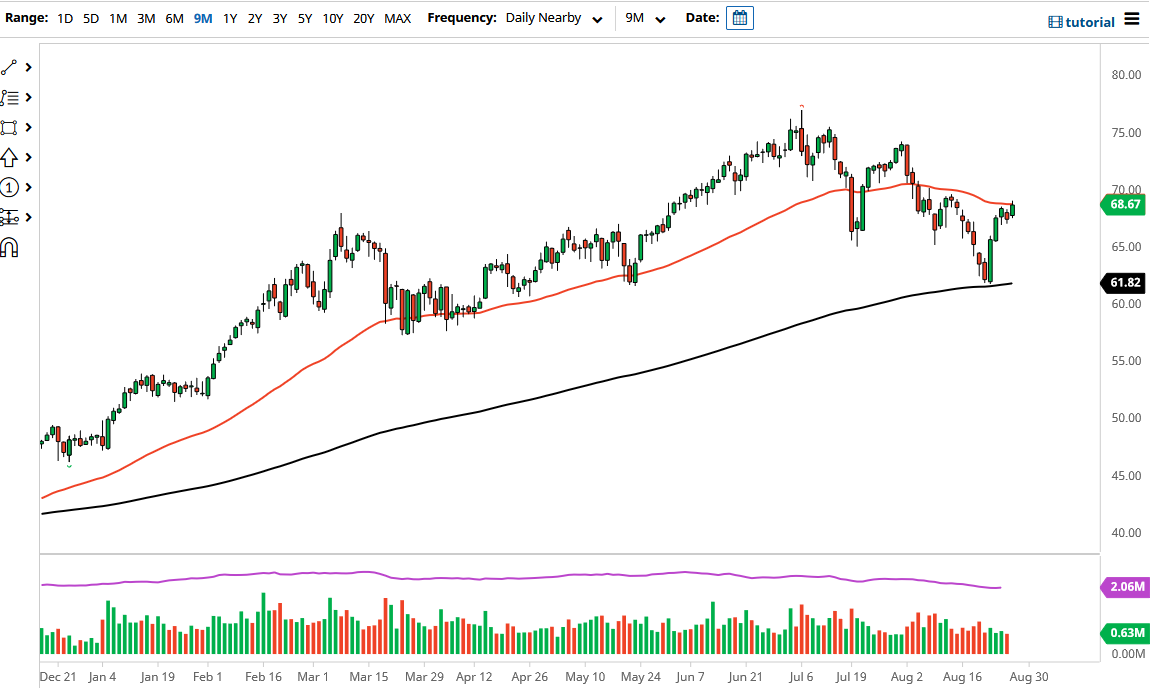

The West Texas Intermediate Crude Oil market rallied a bit during the trading session on Friday to close out the highs of the week. That being said, the market is likely to see a lot of bullish pressure due to this, and the fact that we have pierced the 50-day EMA is the first “shot across the bow” when it comes to the market rallying. If we can break above the $70 level, then the market is likely to continue going even higher, as it would be a previous resistance barrier. $70 is also a very psychologically important figure, so keep that in mind as well. If you see the market clear that, then it obviously is a very bullish sign.

On the other hand, the market breaking down below the $65 level would be extraordinarily negative, opening up the possibility of a move to reach down towards the 200-day EMA again. That being said, we have not made a “higher high” yet, but it seems as if a lot of people are banking on inflation and therefore higher pricing and energy. Natural gas certainly has gotten a boost, as the hurricane is threatening several refineries, so little bit of a “knock on effect” could come into the picture as well.

It is likely that we will see a lot of choppy behavior in the short term, but it certainly looks as if we could eventually see that push higher that we have been waiting for. In fact, you could make a little bit of an argument for a bullish flag, although it is not overly impressive. The couple of massive bullish candlesticks earlier this week should have told you that there is a certain amount of momentum underneath, and now the question is whether or not we can continue to see it play out. The market is likely to see noisy behavior, but the fact that the 200-day EMA turned the market around the way it did and the fact that we had seen so much momentum afterwards does suggest that we have higher pricing becoming much more likely than once thought. This does not mean we will go straight up in the air, but I would have to think that there are plenty of value hunters out there looking to take advantage of this market on dips.