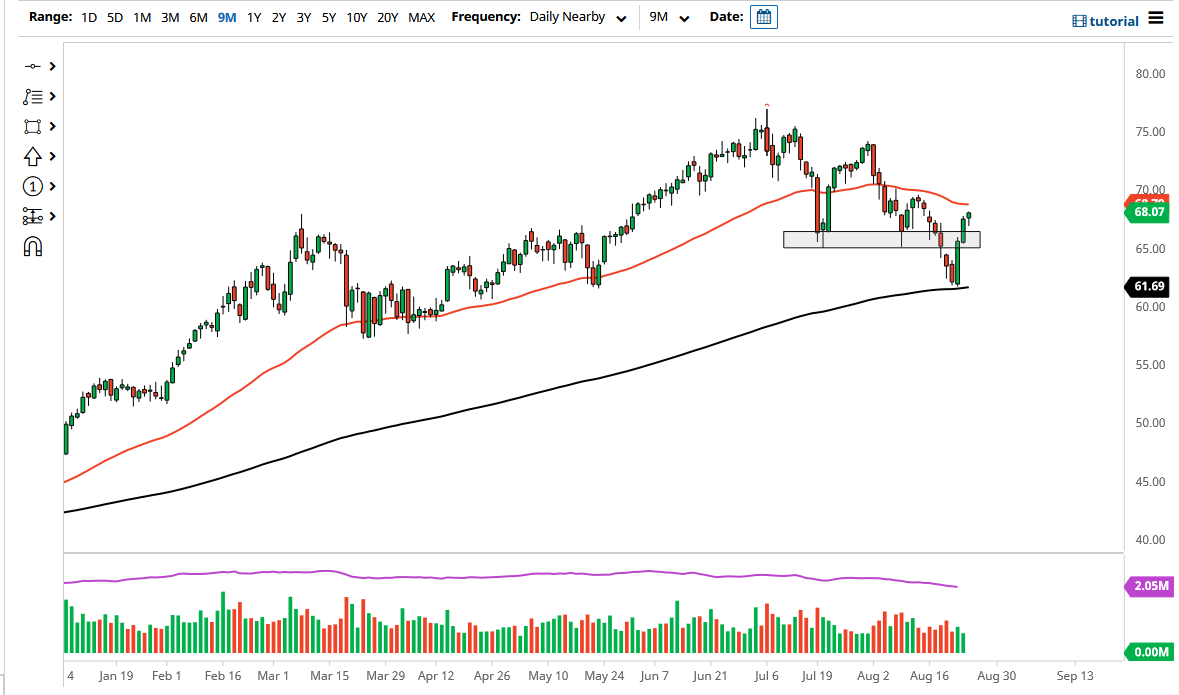

The West Texas Intermediate Crude Oil market initially pulled back on Wednesday but then turned around to show signs of strength yet again. As I write this article, the market has just crossed the $68 level, as it looks like we are heading towards the 50-day EMA. The 50-day EMA does attract a lot of attention, as it is a widely followed technical indicator. The 50-day EMA also sits just below the $70 level, which in and of itself will also be very widely followed as it is a large, round, psychologically significant figure.

To the downside, if we were to turn around and break down below the $65 level, then it is very possible that this market could go back towards the lows, but really at this point I think this is a situation where it is going to be about the idea of global growth and the US dollar. If the US dollar suddenly spikes again, that could be bad for oil. Another thing we need to pay close attention to is the fact that industrial numbers as of late have been rather weak, and as a result it is possible that the demand for oil could be drifting a little bit lower. That being said, the reality is that the market had been oversold, so now we have turned right back around to get overbought.

The thing that is worth paying attention to the most is that we have bounced from the 200-day EMA to form a massive candlestick. That is a sign that there are a lot of buyers underneath looking to get involved, and at this point I think what we are seeing here is a situation that is getting increasingly volatile, but we are still technically in a descending channel, so I would be cautious about getting overly bullish and chasing the trade at this point. The next couple of days should be crucial, and if we end up finishing the week above the $70 level, then I think we will continue the overall uptrend. Otherwise, we may turn around and fall right back towards that 200-day EMA below near the $61.50 level. Expect volatility to say the least.