The West Texas Intermediate Crude Oil market fluctuated during the trading session on Friday as the US Labor Department released its Non-Farm Payroll numbers for the month of July, adding 943,000 to the employment rolls. This means interest rates should rally significantly during the session, as traders are starting to bet on the Federal Reserve having to step in and taper.

Whether or not that is true is a completely different question, because there are a lot of concerns as to whether or not the system can even handle higher interest rates. Nonetheless, when it comes to oil, the strengthening US dollar certainly had its part to play on Friday.

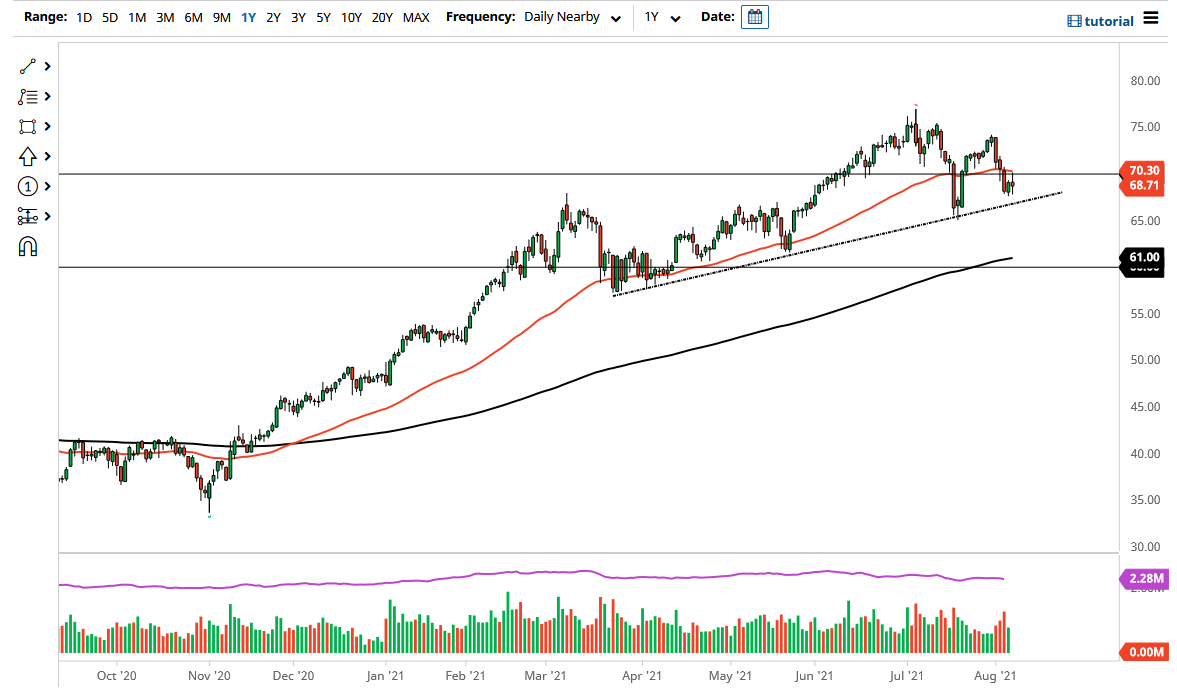

As you can see, there is an uptrend line just below that should continue to offer a bit of support, but at the same time there is a significant amount of resistance in the form of the 50-day EMA and the $70 level. With that being the case, it does make sense that we would squeeze in this general vicinity until we can figure out what to do with the longer-term move, because although the narrative right now is that there should be plenty of demand, the reality is that it looks as if the structure is trying to break down a bit.

If we break down below the $65 level, I think this market will probably be in serious trouble. More likely than not we would see an attempt on the 200-day EMA, but whether or not it can hold is an open question. To the upside, if we were to break above the 50-day EMA then we will almost certainly test the $74.50 level, which is the recent high, but it should be noted that that high is lower than the one before it. We have not made a “lower low” quite yet, but the first part of the beginning of a breakdown has happened, as the most recent high is lower. Ultimately, the next couple of weeks should be rather interesting for this market.