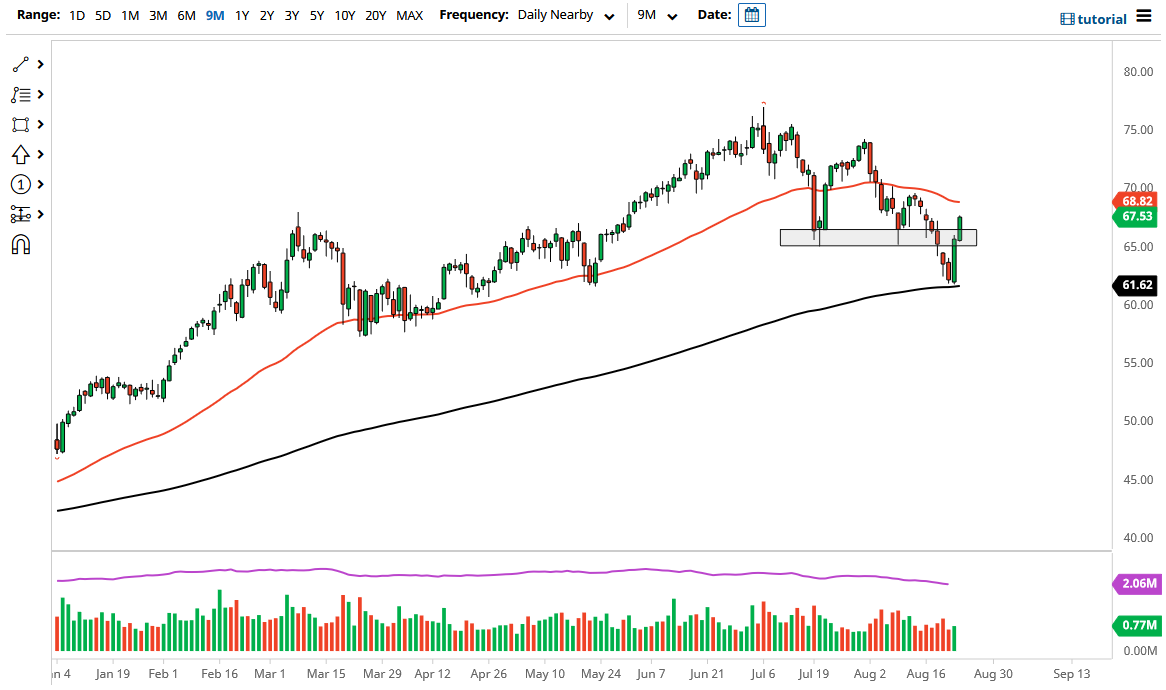

The West Texas Intermediate Crude Oil market powered higher on Tuesday as we continue to see a massive recovery in this market. Looking at this chart, you can see that we are getting close to the gap above, and we also have the 50-day EMA sitting just below the $69 level. Crude oil has recovered quite nicely due to the fact that we have bounced off the 200-day EMA, but whether or not we can continue to go straight up in the air like this is a completely different question, due to the fact that sooner or later we will very rapidly get overbought.

That being said, it is very interesting to see that we have had such bullish moves over the last couple of days, and it does suggest that they very well could be a continuation to the upside. If we break above that 50-day EMA, then we will challenge the $70 handle. The $70 handle would offer quite a bit of psychological resistance as well structural, due to the fact that we have seen a lot of selling in that area.

In the short term, do not be surprised at all to see this market pull back a bit, as the $65 level would more than likely be support. If we break down below that level, then it is likely that the market would go looking towards the 200-day EMA yet again. Looking at this chart, it seems as if the market is going to continue to be very noisy, as traders are starting to try to figure out whether or not the reopening trade is still going to continue to work out, especially as the Chinese mainland has recently concerned traders with the less-than-economically strong fundamental numbers. If that continues to cause issues, then it is likely that oil will continue to drop. That being said, the market had gotten a bit oversold, but now we are just as rapidly overbought. I expect a lot of back and forth and choppy behavior that could cause some issues, and it is likely that we will continue to see more chop than anything else. Keep your position size relatively small, but if we break above the $70 level it is likely that we will take off.