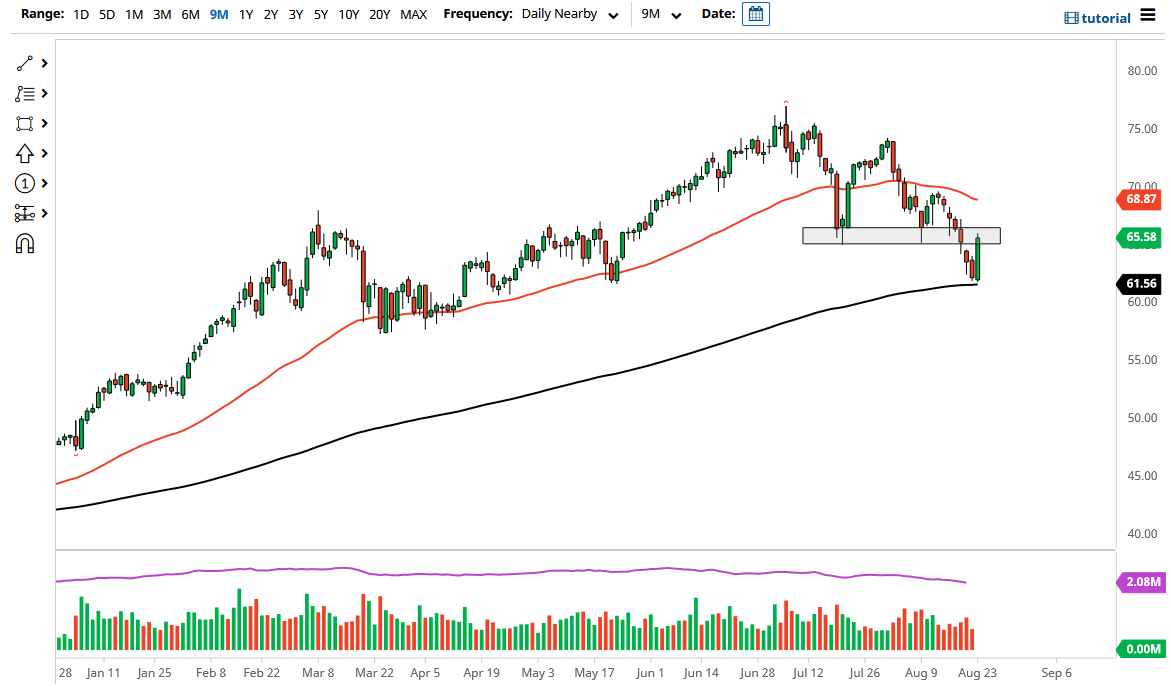

The West Texas Intermediate Crude Oil market rallied significantly on Monday, reaching above the $65 level. This was a very bullish sign and I think the market will continue to see somewhat upward pressure, but at this point we need to pay close attention to what goes on with the US dollar, because with the Jackson Hole Symposium going on this week, there will be statements sooner or later that move the US dollar.

The size of the candlestick is very impressive, and it does suggest that we could go higher. However, if Jerome Powell states at Jackson Hole that tapering is almost certainly coming, it will be a very bullish turn of events for the greenback, perhaps pushing down the value of commodities in general. This has been a huge move during the day, as oil had peaked at roughly a 6% gain. That being said, we are sitting in a relatively important region, which was massive support in the past. In other words, we are currently testing an area that could be extraordinarily difficult to get above. If we get signs of exhaustion, that could be the beginning of another leg lower.

Structurally speaking, the market has been breaking down for a while, as we made a series of “lower highs, and now have made a few “lower lows.” Unless we can break above the $70 level, one has to think that it is only a matter of time before sellers return. This will be especially true if global growth concerns continue to cause problems, but it is worth noting that the 200-day EMA was important enough to have algorithmic traders jumping into the session right away on Monday, so the next couple of days should be very crucial.

As things stand right now, we are sitting between the 50-day EMA above and the 200-day EMA below, which quite often causes a bit of a “squeeze in the market.” I do think that we will have a relatively big move coming sooner or later, and in the short term I would assume that there could even be a little bit more positivity, but until we get through the Jackson Hole meeting, it is probably somewhat limited after this explosive move.