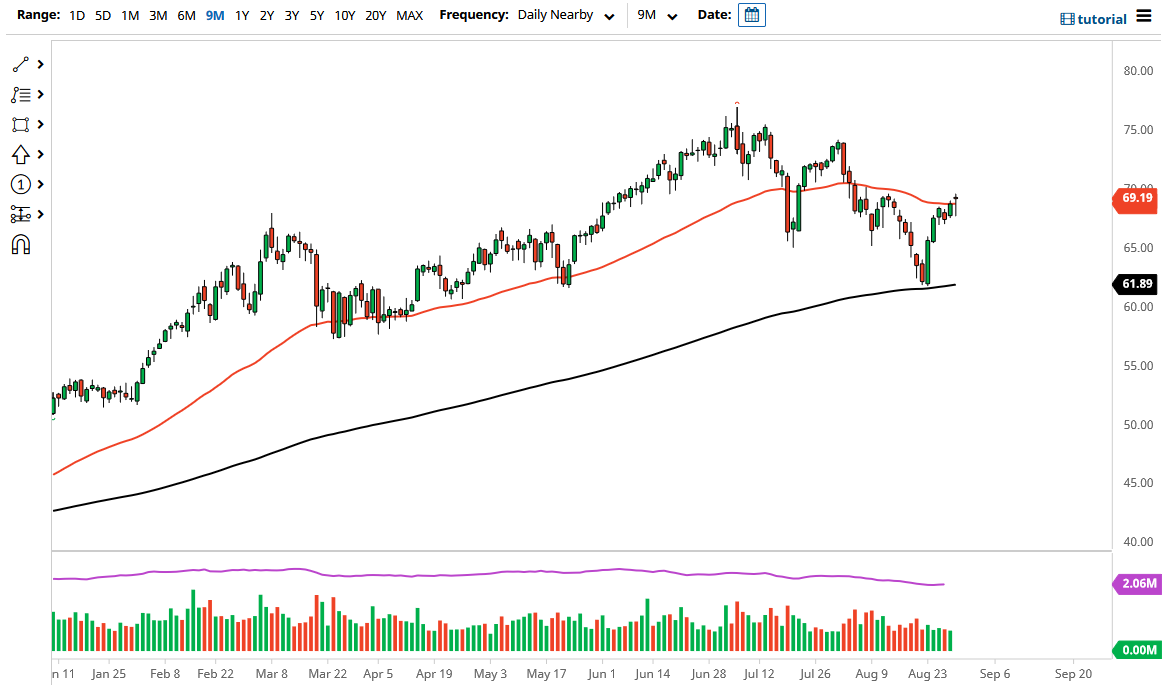

The West Texas Intermediate Crude Oil market was all over the place during the trading session on Monday as the market continues to focus on multiple fronts. The first thing was the hurricane that hit Louisiana, threatening oil production. Ultimately, the market is going to continue to focus on multiple headlines, not the least of which would be damage to US crude oil production. The market ended up forming a bit of a hammer, as we dipped below the 50-day EMA but then turned around to show signs of buoyancy. The market will continue to be very choppy and difficult, because we have quite a few different things going on.

Ultimately, we are also taking a look at OPEC and the possibility that they are going to raise production in the next couple of days, and that could send the oil market lower as well. That being said, the $70 level above would be significant bullish pressure, and if we can get above there it is likely that the market could go towards the $74 level. That being said, pay close attention to the US dollar because it does typically have a negative correlation to what happens here. Ultimately, this is a market that does look like it wants to go higher, but depending on what OPEC says, things could change quite drastically.

Furthermore, the market is going to be paying close attention to global demand going forward, so pay close attention to those inventory figures. The market breaking above the 50-day EMA is a good sign, though, and technically speaking, as long as we can get above the $70 level, it is likely that we will see a lot of momentum jumping into the market. On the other hand, if we were to turn around and break down below the $67.50 level, then the market could go looking towards the $65 level, possibly even the 200-day EMA after that. This is a market that I expect a lot of noise from, especially as we get closer to the OPEC announcement. Be aware of the fact that quite often you will see rumors appear to manipulate the market as OPEC has meetings. Unfortunately, that is part of the game, and you are trading crude oil.